Table of Contents

In the landscape of decentralized finance (DeFi), a new and very competitive scene has evolved: decentralized perpetual exchanges (perp DEXs).

The daily trade volumes on decentralized exchanges topped $1 trillion in September 2025, growing from a few billion dollars in early 2024.

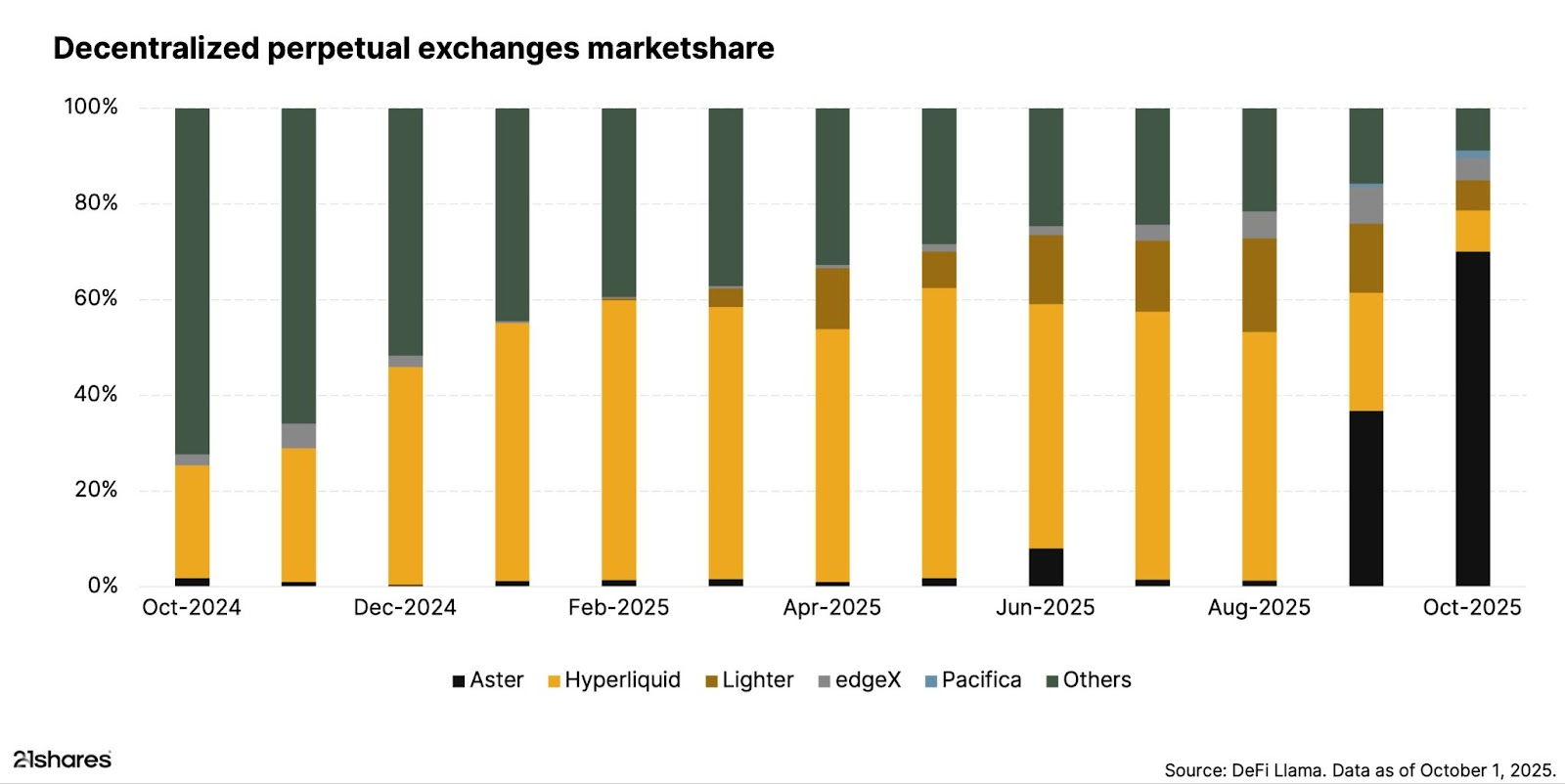

Throughout the remarkable transformation of the past year, Hyperliquid emerged as the clear frontrunner, holding approximately 70% of the market share. However, by October this year, its supremacy had waned as Aster and Lighter emerged in the market.

Currently, the perpetual derivatives market is highly competitive, featuring a trio of platforms that present unique technical advancements and product innovations, fundamentally altering the way traders engage with decentralized finance.

Compared to previous iterations, such as GMX, or DYDX this new version of perpetual decentralized exchange, or perp dex stands out.

Aster has accomplished the incredible feat of completing the initial phase (TGE). The recent airdrop, along with price spikes and the wealth that followed, has proven once again that it is a top-notch marketing strategy.

With the addition of Hyperliquid and Aster's considerable visibility and user involvement, the market's liquidity dynamics have been brought to light once again.

Now that Aster's TGE is behind us, everyone is thinking about how to continue growing the community, namely, how to attract and keep real traders and how to manage fee income.

The increase in non-real fee income is just a transitory boost that won't last.

Aster vs. Hyperliquid

Hyperliquid operates as a sophisticated central limit order book exchange, constructed on an exclusive layer-one blockchain.

Aster embodies a comprehensive strategy, serving the needs of both beginners and seasoned users (Pro = order book, 1001x Simple = one-click/AMM style) while enabling multi-chain connectivity and advancing towards an independently developed Layer 1 solution (Aster Chain).

The 1001x Simple model is designed for novices and casual participants, providing an effortless one-click trading experience that appeals to individuals who are just entering the market, making it a valuable asset for drawing in new users.

Hyperliquid outperforms Aster in terms of performance and liquidity, thanks to its on-chain matching and more suitable environment for quantitative trading.

On the other hand, capital that values secrecy regarding orders and trading direction will find Aster's Pro mode, which includes anti-MEV techniques and disguised orders, to be an excellent fit.

Both entities have similar basic fee structures, with Aster having a slightly lower rate (0.01% maker / taker 0.035%, Hyperliquid 0.01% maker / taker 0.045%).

The HYPE staking feature of Hyperliquid might reduce fees by as much as 40%, while Aster offers discounts to VIPs.

When compared to Hyperliquid, Aster stands head and shoulders above the competition thanks to its multi-chain strategy that "eliminates mental bridging" and supports a wide range of blockchains, such as BNB Chain, Ethereum, Arbitrum, Solana, and many more.

When it comes to product extension, Hyperliquid has a user/protocol treasury (HLP), spot trading, and the USDH stablecoin, which was established through a 'competitive bidding' issue. The USDH code positions were secured by Native Markets.

Spot trading is available, Aster is branching out into index and stock perpetuals, yield collateral (such as BNB/USDF) is provided, and execution privacy is guaranteed.

To guarantee privacy, Aster uses the term "dark pools" deliberately. The secret order functionality has been launched successfully. With this function, users can hide their limit orders from the order book, keeping the amount and direction hidden. To avoid keeping tabs on large orders, it says it uses cutting-edge privacy technology.

Dominance to Competition as More Players Enter

In October, a significant shift took place in the dynamics of Perp DEXs. Lighter, now in private beta and having gone live on the mainnet on October 2, captured 15%, while Hyperliquid's share decreased to around 10%, and Aster led with nearly 70%.

Daily volumes of $10 billion to $15 billion for hyperliquid indicate steady but moderate involvement. But at $13.5 billion, compared to $3 billion for Aster, its open interest is more than four times bigger.

In late September, Aster's trading volume was at $1 billion; by the end of the month, it had jumped to over $70 billion, solidifying its position as the market leader.

Launching its mainnet on October 2, Lighter is processing almost $8 billion daily, showing tremendous pace ahead of a bigger rollout. Currently, the network is functioning on an invite-only basis.

This transition highlights that liquidity and user engagement are now distributed across multiple platforms. Rather, innovation is causing the market to splinter into niche players.

In this environment, Aster has positioned itself as the clear frontrunner, yet uncertainties remain regarding the authenticity of its growth trajectory.

A slew of new perpetual exchanges are popping up, and they're all about improving speed and security by tying in closely with Ethereum.

As a result of increased competition across platforms, Perpetual protocol's monthly trade volume surpassed $1 trillion in September.

The Block's data dashboard indicated that September's total reached $1.05 trillion, marking a 48% rise from August's $707.6 billion volume.

With the help of YZi Labs and BNB Chain, Aster rose from relative obscurity to become the most active perpetual swap trading platform last month, with over $420 billion worth of transactions. September trade volume for the once-leading Hyperliquid platform was $282.5 billion, down 29% from August's total of $398 billion.

This dropped the platform to second place. Aster is expected to improve its Perp DEX trading platform with the introduction of its own Aster Chain, which is planned as a ZK-based Layer 1.

Ether Platform Anyone?

With $164.4 billion in September activity alone, Lighter, a decentralized exchange running on Ethereum Layer 2, has achieved an impressive third position—all while being in private beta—and has been making a significant impact in recent months.

Lighter, which boasts 188,000 unique accounts and over 50,000 daily active users, could pose a threat to Aster and Hyperliquid in the everlasting protocol space with the introduction of its public mainnet on Wednesday. Lighter is expected to reach a wider trading audience.

Although it was among the pioneers in decentralized trading platforms, Synthetix has experienced significant neglect in 2025, with notional trading volumes plummeting over 90% compared to the same timeframe in 2024 through the first three quarters of 2025.

Synthetix plans to redeploy on Ethereum Layer 1 with a new strategy that combines the efficacy of centralized exchanges with Ethereum's strong security features in order to regain its position as the market leader in perpetuals.

"There is no perp DEX on Ethereum. We need a perp DEX on Ethereum." @kaiynne explains why Synthetix is returning to Ethereum Mainnet on @BanklessHQ pic.twitter.com/z6z6uUnr7N

— Synthetix ⚔️ (@synthetix_io) September 23, 2025

Given that successful exchanges require sub-second responsiveness and Ethereum produces blocks every 12 seconds, this type of deployment was previously considered unfeasible.

Nonetheless, Synthetix's innovative structure distinguishes between offchain orders and on-chain settlement.

The new Synthetix will aggregate off-chain orders and execute settlements with each Ethereum block, while maintaining position margins on Layer 1.

This approach resembles the way numerous transactions are aggregated and finalized on Ethereum following a brief delay.

What Next?

Hyperliquid L1 has come out on top, whereas Aster Chain is still in the pre-launch stage. At the moment, Hyperliquid is ahead of Aster in terms of both trading volume and open interest, and it also has the best ecology and community.

Moreover, Hyperliquid shows great promise in the HIP, especially in the creative domains of HIP-3 and HIP-4, which were created in tandem with the ecosystem and community partners.

Many are waiting for Aster L1 to appear soon, after which AIP-1, AIP-2, AIP-3, etc. will be introduced.

Similar to how the fifth-generation saw improvements over the fourth, Hyperliquid aspires to outdo Aster's generation.

The fourth generation may be able to maintain its position in the field of comprehensive systematic warfare; nevertheless, the key to success will be joint ecological initiatives.

The entity that will take the last "AWS of Liquidity" remains a mystery.

Separately, Lighter and Synthetix are competing to offer the best high-performance trading platform that is based on blockchain technology. Both solutions adhere to the concepts of Ethereum's Layer 2 design, which combines the speed of offchain transactions with the certainty of on-chain finality. This solves the problem of user centralization by utilizing Ethereum's Layer 1 for asset custody.

Traders are given similar settlement guarantees by both Ethereum-aligned exchange implementations; nevertheless, due to reliance on offchain orders and competition for millisecond performance, there is an unintended concentration of transaction processing.

As things are, not a single design is perfect.

There is still a lot of room for improvement in the quest to create the perfect Ethereum-aligned permanent decentralized exchange, even though innovations like decentralized sequencing and required transaction inclusion could improve trustless assurances.

Elsewhere