Table of Contents

Capitalising on hype has been the crypto industry's core mantra but not all hype is good hype.

As the US presidential election draws ever closer, Donald Trump continues to ensure that his name remains in the spotlight, offering mainstream media headline after headline. This week, Trump's highly anticipated crypto project, World Liberty Financial (WLFI), launched to much avail. Although only selling a fraction of its tokens, the project succeeded in keeping Trump relevant in the crypto community, for better or worse.

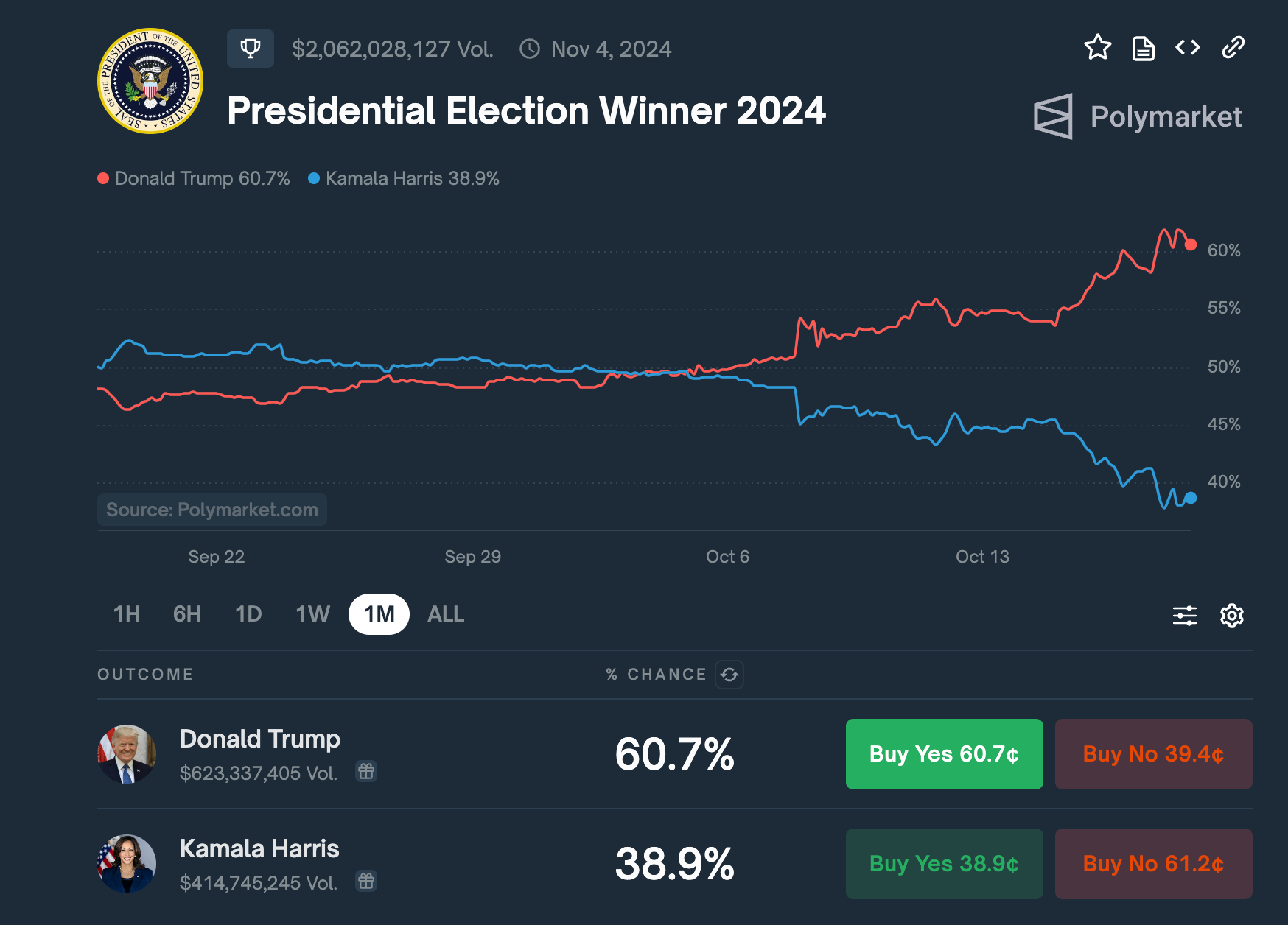

Now comfortably in the lead on Polymarket, Trump is making the last push to cement his support from the crypto industry, generating as much hype in the sector as possible, proudly declaring, "Crypto is the future," during the launch of WLFI.

Whether you're a Trump supporter or not, it's hard to argue that Trump's tactics are unethical. Insincere perhaps, but certainly above board. The same cannot be said for degens shamelessly capitalising on the untimely death of former One Direction singer, Liam Payne.

Payne, who died on Wednesday after falling from his hotel balcony in Argentina, shocked the music industry with his untimely passing. The crypto industry, however, saw this as an opportunity.

Within just 24 hours of Payne's death, degens flooded the market with more than 150 tokens in the guise of "tributes" to the singer. The first memecoin themed around Payne’s death was created just minutes after his death occurred around 5 PM in Argentina (UTC−3).

Some projects promised to donate minor percentages of proceeds to Payne's loved ones and supported charities. Others claimed to pay tribute to his dog while more egregious projects paid hommage to the balcony he fell from and the room he seemingly trashed before his fall.

Whilst there's certainly nothing unlawful about profiting off a celebrity's death, it doesn't exactly portray sound ethics. At a time when the industry is supposedly maturing, such degen behaviour is a painful reminder that the crypto industry will forever be the wild west of finance.

Speaking of ethics, this week also saw Sam Altman rebranding his Worldcoin project to enhance his iris-scanning, ID-snatching, soul-selling orbs. Built using Nvidia hardware, the orb is now five times more powerful and efficient despite being smaller with fewer components.

On a more cheerful (and rather random) note, Bitcoin and Oasis might have more in common than you think. Our guest writer has been feeling supersonic about Bitcoin as he talks tonight about why the leading crypto and Oasis aren't half the world away from each other. Yeh, we said maybeee too.

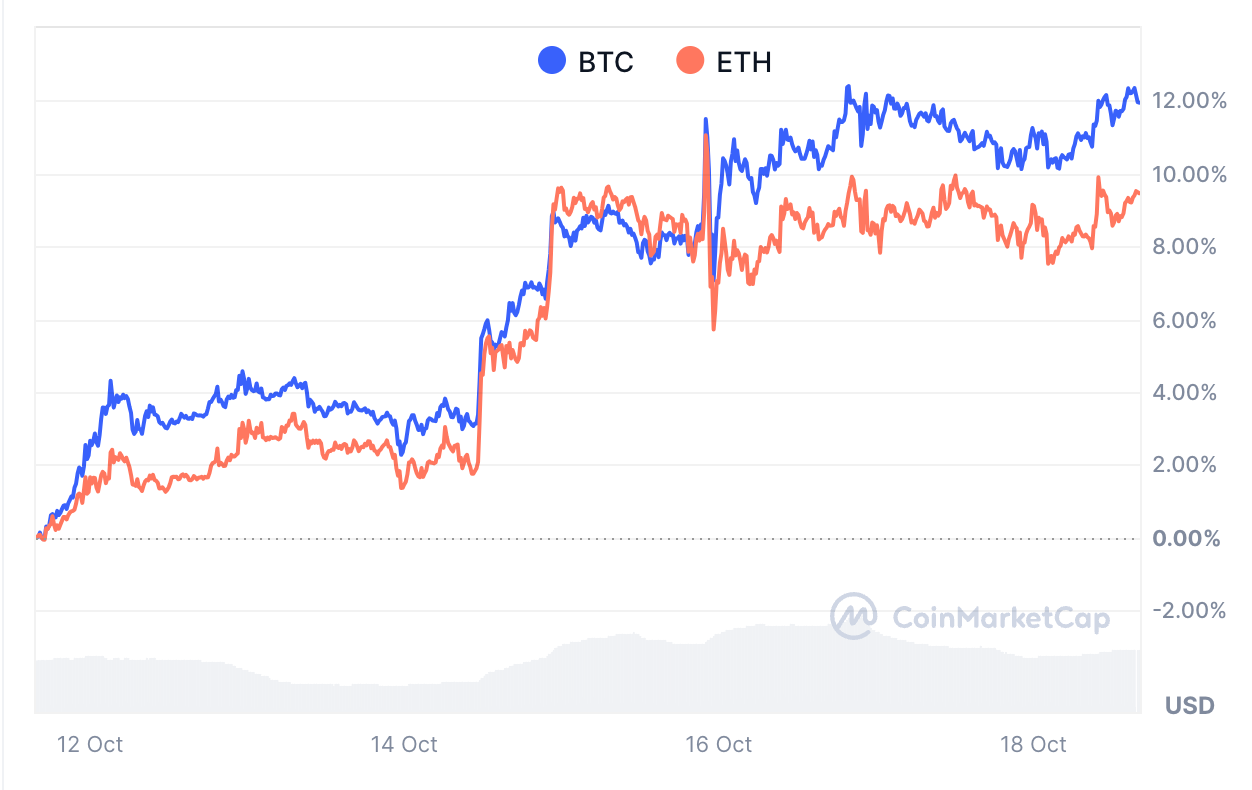

Over in the markets, there's more good news. Bitcoin is up around 12% over the week while Ethereum is up almost 10%.

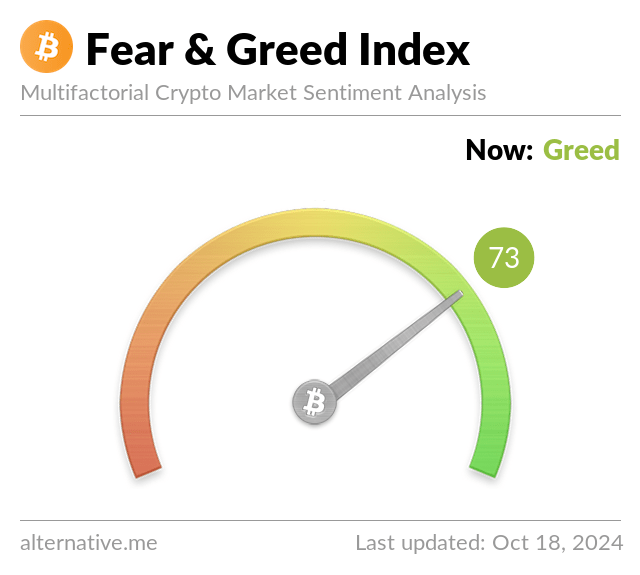

Risk appetites have remained the same, 73, "Greed." The Fear & Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

As always, fear not (greed not) as BRN has you covered. "The combination of strong ETF inflows and macroeconomic catalysts points to an imminent breakout," BRN analyst Valentin Fournier explains.

"If Bitcoin avoids a rejection over the weekend, it could reach $70,000 by Monday for a final test. We maintain our recommendation of heavy exposure to Bitcoin, with a preference for Bitcoin over Ethereum, as this rally could accelerate further."

The European Central Bank's decision to reduce interest rates by 25 basis points is a positive development for the global economy. This rate cut is expected to increase liquidity across markets, boosting the performance of risk assets such as $BTC.

— BRN (@thebrn_co) October 18, 2024