Table of Contents

The market discussion revolves around the 50 basis point cut by the US Federal Reserve last week, and almost everyone is saying, "That is how you sell a 50 bps cut."

Fed Chair Jerome Powell was confident with that 50 bps cut. He sold it well.

Remarkably, with no material macro fears, more to prevent macro strain. But if that means a greater probability attached to a soft landing, it also reduces room for long rates to fall.

BRN thinks they can edge higher, at least for now. We saw some of that post the FOMC.

Prepare for a bit more ahead.

In the wake of the Federal Reserve's massive interest rate decrease, global shares rose, and Bitcoin reached a three-week high.

The digital token last traded above $63,800, having risen nearly 9% over the past week.

Stock markets around the world rose.

For the first time in more than four years, the central bank lowered borrowing costs by 50 basis points.

However, Chair Jerome Powell was cautious about pledging to maintain the same rate moving ahead, stating that actions would be driven by economic data.

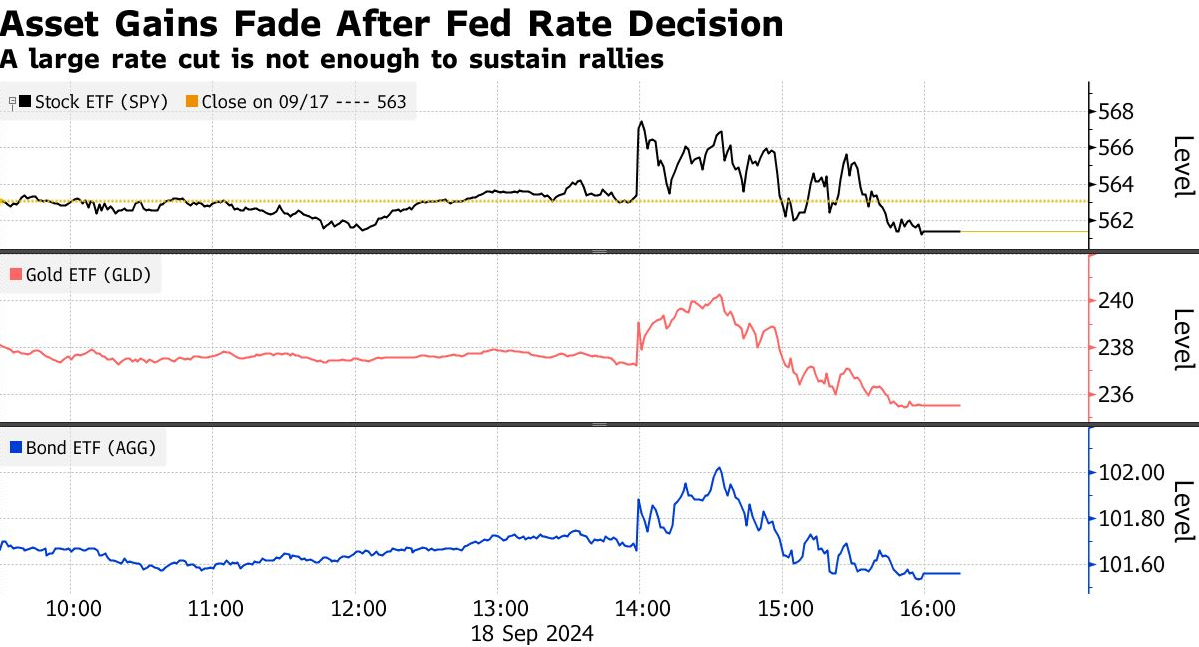

That nuanced perspective subdued the market's reaction during US hours on Wednesday.

Everyone on Wall Street was hoping that Jerome Powell would finally reverse decades of restrictive monetary policy by reducing the interest rate, and Powell delivered.

This would explain the sharp surge in equities and bonds.

The S&P 500 index jumped as much as 1% for a short period as equities, particularly those of economically vulnerable corporations, rose.

Bonds were no different, and speculative assets like cryptocurrency were first driven up by the hope of future easy money.

However, by the end of the trading day, the profits had evaporated due to the more gloomy economic and financial realities that had set in.

The investment environment remained murky despite the half-point rate decrease and other robust policy measures often reserved for times of recession or financial catastrophe.

All major assets were down by the end of Wednesday.

The drops weren't huge but were the first coordinated selloff following a Fed policy decision since June 2021.

When the stock and bond markets turned lower, traders were especially worried about two statements Powell made simultaneously: that the Fed will not make half-point reductions a habit going forward and that the neutral interest rate level is probably higher than before the pandemic.

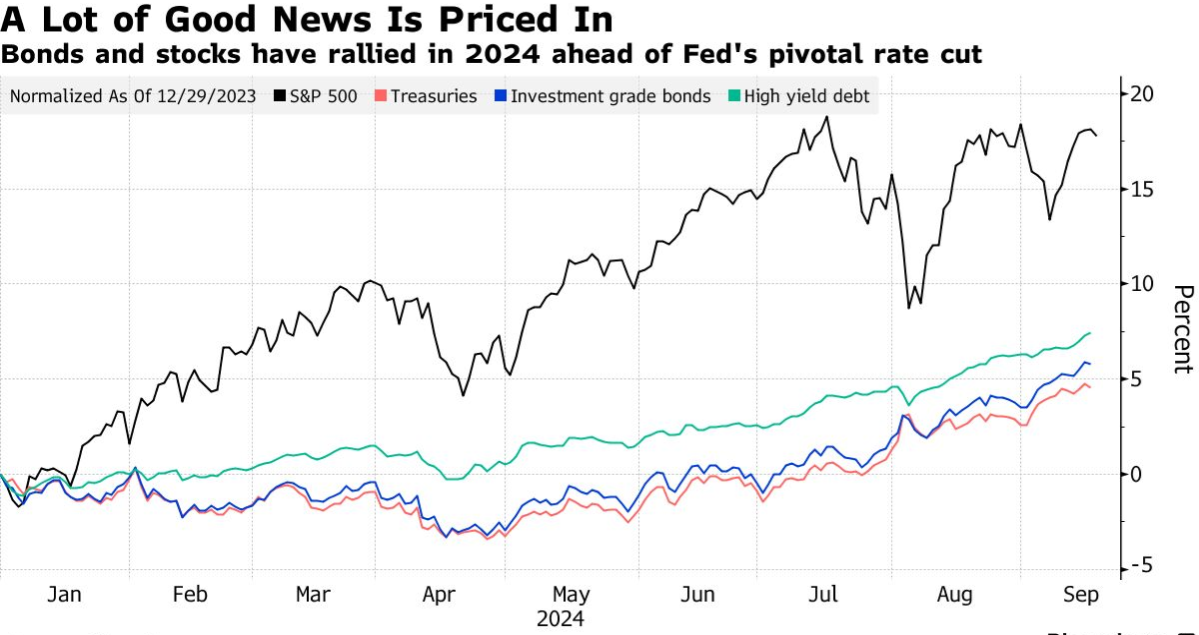

Already factoring in a slew of rate cuts, the bond market had staked significantly on Wednesday's action, so it was essentially already factored in.

For instance, after reaching above 5% in late April, the yield on two-year Treasuries had already fallen steeply, reflecting multiple rate decreases.

Policymakers pencilled in a further percentage point of cutbacks, as per their 'Dot Plot' predictions. On the other hand, traders are still hoping for a faster pace.

However, the start of the much-anticipated easing cycle boosted risk assets through to the end of last week.

The market took time to grasp the broader perspective and begin to reflect the better outlook.

Bitcoin and other risky assets benefit greatly from a strong beginning to the easing cycle.

Upcoming US data might reveal whether last week's 50-basis-point Fed rate cut marks the beginning of a string of aggressive cuts.

The US Fed wants to get to neutral quickly as it increasingly prioritises potential job weakness at a time when it is more comfortable with the inflation backdrop.

The scope and size of this cycle will soon be the centre of attention.

BRN looks for a further 150 bps of cuts by next summer, but the risks are skewed towards the central bank doing more.

Whether the Fed would choose a quarter-point or half-point shift was a matter of deep debate before the meeting.

As the risks associated with the US labour market rose and inflation levelled off, Powell and his colleagues are working to maintain the economy's strength.

From this point forward, the course of economic activity will be the most important indicator to monitor.

Recent spikes in the correlation between cryptocurrency and more conventional investment vehicles, such as equities, suggest that macroeconomic issues are impacting digital asset markets.

It still needs to be made clear what the Fed's continuing response function is, and their journey is yet unplanned.

However, Bitcoin enthusiasts saw the latest 50 bps cut as a strong start and a boost to crypto's appeal, similar to stocks. The top token jumped above its 100-day trading average after the Fed's move.

As of publication time, Bitcoin is trading at $63,772.42, per CoinMarketCap data, up 9.10% in the past week.