Table of Contents

The US Supreme Court has ruled against Coinbase but despite the industry's derision towards the lawmakers, the decision could be a welcomed move.

In a case dating back to 2021, the US Supreme Court chose not to side with Coinbase over a controversial Dogecoin sweepstakes competition. Disgruntled consumers had accused the exchange of using misleading tactics to promote the competition.

Dodgy DOGE

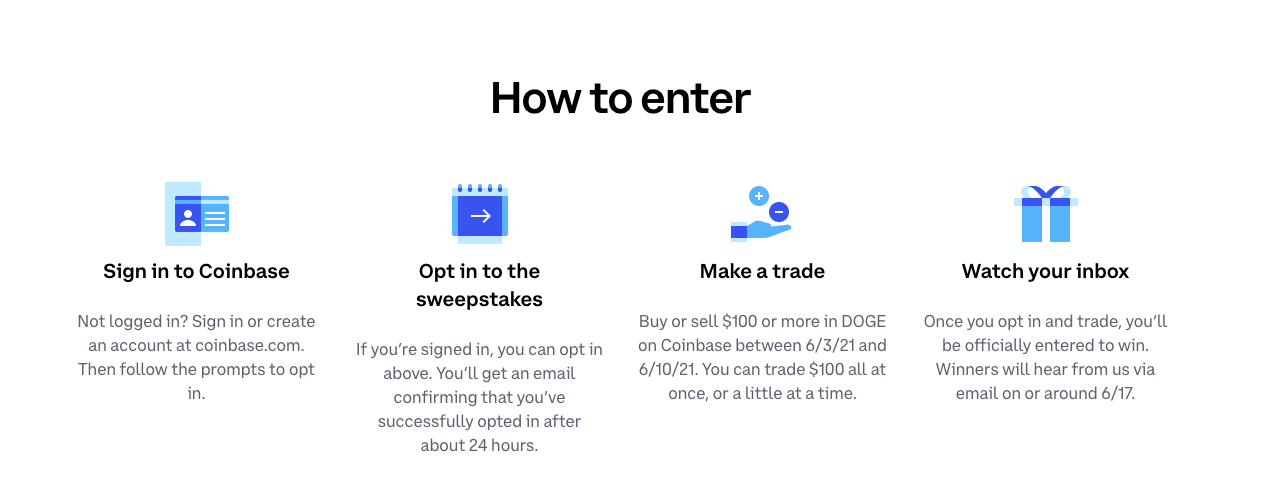

Filed by former Coinbase user David Suski, the class-action suit claimed that Coinbase's "Trade Doge, Win Doge" competition deceived customers into believing that they must buy or sell $100 worth of DOGE to win cash prizes.

"Dogecoin is now on Coinbase, and we’re giving away $1.2 million in prizes to celebrate," said the company at the time.

Fine print found in the contest stated customers could actually enter for free by handing over certain information due to American laws that prevent purchase requirements for sweepstakes. Suski, as well as other plaintiffs, argued that they would not have spent the $100 if they were aware of this loophole.

Dodging Arbitration

Coinbase attempted to settle the case via arbitration on the basis that every customer must consent to its user agreements. In November, a federal judge ruled that the terms of the sweepstakes superseded the customer agreement.

Nine out of nine Supreme Court justices agreed that it is the responsibility of a lower court to determine which of the two agreements should take precedence, overruling Coinbase's request for arbitration.

"Arbitration is a matter of contract and consent," emphasized Justice Ketanji Brown Jackson. "Before either the delegation provision or the forum selection clause can be enforced, a court needs to decide what the parties have agreed to."

The court further rejected Coinbase's argument that the ruling would "invite chaos by facilitating challenges to delegation clauses."

Following the ruling, Coinbase’s Chief Legal Officer Paul Grewal tweeted, "Some you win. Some you lose. We are grateful for having had the opportunity to present our case to the Court and appreciate the Court's consideration of this matter."

What a week. Some you win. Some you lose. We are grateful for having had the opportunity to present our case to the Court and appreciate the Court's consideration of this matter. https://t.co/FLTKRU7UUG

— paulgrewal.eth (@iampaulgrewal) May 23, 2024

Dodgy Business

Whilst the crypto industry usually stands in solidarity against lawmakers, this particular ruling could usher in a new era of consumer protection across not only crypto but the wider business landscape.

Unlike Coinbase's other legal battles, the Supreme Court's decision did not directly impact Coinbase's crypto business. Instead, the decision offers clarity on the Federal Arbitration Act, which notoriously protected businesses from going to court to settle customer disputes.

Ethical business practices apply to all firms and should be welcomed by the crypto industry too. It's also a reminder to crypto firms that they're accountable for practices beyond digital asset laws.

Blockhead x Coinfest

On Blockcast this week, we take a closer look at the crypto media space and the opportunities for Web3 adoption in Southeast Asia. Our guest, Steven Suhadi, co-founder of Indonesia Crypto Network (ICN) and Coinfest Asia, and board member of the Indonesian Blockchain Association shares his insights on building a successful Web3 media business, navigating the current market trends, and the potential of Web3 projects in the region. We also delve into ICN's publications and the upcoming Coinfest edition.

Get ready to connect with 6,000+ people from 2,000+ companies at the largest Web3 festival in Asia. Get your tickets now with Blockhead's 10% discount code: CA24BLOCKHEAD

Elsewhere