Table of Contents

A watershed moment has unfolded for the crypto industry as the US House of Representatives approved a major bill to establish digital asset regulations.

The Financial Innovation and Technology for the 21st Century Act (FIT21) provides the "regulatory clarity and robust consumer protections necessary for the digital asset ecosystem to thrive in the United States," according to Chairman Patrick McHenry.

The legislation aims to create a framework for regulating digital assets by offering consumer protection measures and designating the Commodity Futures Trading Commission (CFTC) as the main regulator for digital assets and non-securities spot markets.

This should provide clearer definitions for distinguishing between crypto tokens as securities or commodities.

Achieving bipartisan support, the bill was passed with a 279-136 vote, marking the first time a major crypto bill has cleared a Congress chamber.

"The bill also ensures America leads the financial system of the future and remains a hub for technological innovation," he added.

Celebrating the Bill

FIT21's passing has been celebrated by politicians and crypto industry leaders alike.

"The overwhelming support for FIT21 in the House should serve as a wakeup call to the Senate and this Administration. They must come to the table to ensure the Americans who engage with digital assets can do so safely," McHenry said.

Representative French Hill said the bill's passing marks a "historic day for American consumers, investors, and innovators" while Representative Dusty Johnson said that "without this bill, digital asset innovation will continue to be filled with uncertainty."

"Today’s victory gets us one step closer to establishing clear rules of the road for developers in the industry so America can remain a global hub for tech and finance innovation," he added.

I would argue that #FIT21 is responsive to both President Biden's own Executive Order and the FSOC report calling on Congress to enact a framework for digital assets - and that's what we've done.

— French Hill (@RepFrenchHill) May 22, 2024

We must pass #FIT21 today. pic.twitter.com/k9g0HW1IwD

Meanwhile, Coinbase CEO Brian Armstrong described the vote as "historic" and that the bill will "finally start to create some clear rules to regulate crypto (if it becomes law)."

"Americans want to know their representatives are protecting their rights to use crypto, creating clear rules to protect consumers, and won't let the lack of clarity be weaponized by a few activists in the administration trying to unlawfully kill an industry," he said.

Historic vote today on the FIT21 bill in the House of Representatives, that will finally start to create some clear rules to regulate crypto (if it becomes law).

— Brian Armstrong (@brian_armstrong) May 22, 2024

Americans want to know their representatives are protecting their rights to use crypto, creating clear rules to…

Demonized Democrats

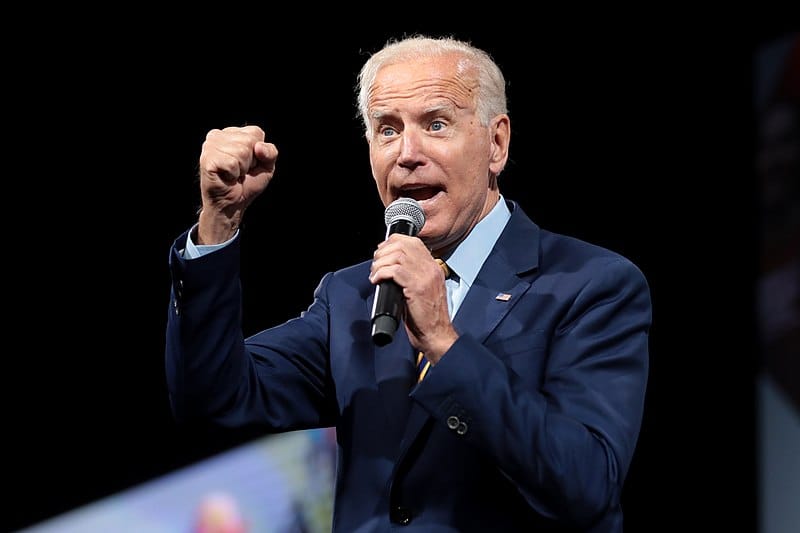

71 Democrats and 208 Republicans voted in favour of the bill, while 3 Republicans and 133 Democrats voted against it. Both President Joe Biden and SEC Chair Gary Gensler have opposed the bill.

"The Financial Innovation and Technology for the 21st Century Act ('FIT 21') would create new regulatory gaps and undermine decades of precedent regarding the oversight of investment contracts, putting investors and capital markets at immeasurable risk," Gensler said.

Coinbase Chief Legal Officer Paul Grewal took to X to highlight how 71 Democrats have "joined Republicans to defeat the scape goating, fear mongering and ignorance of fellow legislators who refused to legislate."

71 House Democrats. Let that sink in— 71 House Democrats just joined Republicans to defeat the scape goating, fear mongering and ignorance of fellow legislators who refused to legislate. Thank you Congress— FIT21 is real progress.

— paulgrewal.eth (@iampaulgrewal) May 22, 2024

Ripple CEO Brad Garlinghouse echoed a similar message. "Today, more than ever, we are seeing what a political liability Gensler has been to the Biden administration," he stated. "It's the reason we saw 71 Dems cross the aisle and support FIT21."

Well, this certainly HAS aged well!

— Brad Garlinghouse (@bgarlinghouse) May 22, 2024

Today, more than ever, we are seeing what a political liability Gensler has been to the Biden administration.

It's the reason we saw 71 Dems cross the aisle and support FIT21.

We are just getting started! https://t.co/Ff6x78mgax

Congressman John Rose said he has "had enough of Biden Administration officials regulating by enforcement" and that's why he supports FIT21, calling it legislation that will "prevent the government from standing in the way of digital innovation."

I’ve had enough of Biden Administration officials regulating by enforcement. That’s why I support #FIT21, legislation that will prevent the government from standing in the way of digital innovation.

— Congressman John Rose (@RepJohnRose) May 22, 2024

The bill includes critical guardrails that will protect consumers and foster… pic.twitter.com/akXRtke0Py

The vote comes at a time when Republicans seem to be capturing the attention of the crypto industry.

Crypto for Trump

Both the US Senate and the House of Representatives are also calling to overturn the SEC's controversial crypto accounting policy but President Biden has drawn flack for vetoing it.

Known as Staff Accounting Bulletin No. 121, the rule requires companies to list crypto assets on their balance sheets, increasing the expense for financial institutions to deal with cryptocurrencies.

Cardano founder Charles Hoskinson described Biden's move as a "coordinated effort to kill crypto" and the latest in what he called "Operation Chokepoint 2.0."

“This November, if you vote for Joe Biden as a cryptocurrency holder, please understand that the intent of this administration is to destroy the American cryptocurrency industry,” he said on X. "Understand that. It’s unambiguously clear.”

Meanwhile, Donald Trump is becoming a more favourable candidate among the crypto community, after declaring, "If you're in favor of crypto, you'd better vote for Trump."

Sour Senate Won't Sour the Party

Having passed through the House of Representatives, FIT21 will now head to the Senate. However, there's no guarantee that the Senate will echo the same positivity.

Senator Elizabeth Warren is notoriously a crypto cynic and is unlikely to warm to the bill. "Crypto was the payment method of choice for international drug traffickers who raked in over a billion dollars through crypto," she said at a hearing last year.

"Crypto helps those drug traffickers and rogue states launder money nearly instantaneously... If they couldn't use crypto, would ransomware gangs even exist?”

A new @USGAO report confirms that rogue nations are using crypto to dodge sanctions and undermine our national security.

— Elizabeth Warren (@SenWarren) January 21, 2024

It’s time for crypto to follow the same anti-money laundering rules as everyone else. I’ve got a bill to make it happen. https://t.co/TUX2sJ8HR0

While the Senate did pass a resolution to nullify the SEC’s Staff Accounting Bulletin No. 121, which Biden opposed, there's no guarantee the Senate will extend its warmth further.

“There’s a decent chance that progress stops after this vote, but that doesn’t mean that this is a useless exercise,” said Rashan Colbert, a former US Senate staffer.

The bill requires 51/100 senators to vote in favour of it to pass. Rounds of changes could also jeopardise the bill's goal. Furthermore, Biden will have 10 days to sign or veto FIT21, of which the Senate could override him.

Nonetheless, FIT21's success thus far won't be in vain. Its passing through the House of Representatives shows political symbolism and intention to regulate the digital asset space.

Lawmakers and regulators can use FIT21 as a framework to develop regulations and evolve crypto laws.

Elsewhere