Table of Contents

Incorporated in Switzerland and Singapore, Sygnum is a global digital asset banking group that brings old money to new. With a valuation of US$900 million, Sygnum is on a mission to accelerate the development of its fully regulated products and expand in Europe and Asia.

Sygnum Asset Management is part of the Sygnum umbrella, offering solutions across a spectrum of crypto-centric investment strategies to investors who are seeking to participate in the broad-based crypto megatrend, generate income, extract alpha and/or participate in the early-stage growth of leading digital asset companies.

We sat down with Senior Vice President and Product Specialist at Sygnum's Asset Management business, Benedict Yap, CFA, to learn more about their offerings and how the firm employs tried-and-tested principles and disciplines from the field of traditional investing in the world of digital assets.

With a career spanning more than two decades in the investing arena, Yap has built a formidable resume of TradFi experience that includes Head of ESG at Lion Global Investors, Equities and Alternatives product specialist at Fullerton Fund Management, Senior Researcher at Mercer Investments, and hedge fund analyst at the EIM Group. Earlier in his career, he even did stints at Ernst & Young and the Monetary Authority of Singapore (MAS).

Yap now brings his vast knowledge of the industry to Sygnum’s asset management capability.

TradFi's Renewed Interest in Crypto

Cryptocurrency has earned itself a notoriously risky reputation, and rightly so. Sam Bankman-Fried makes Bernie Madoff look like an amateur while Binance's US$1.35 billion fine is the largest ever imposed by the U.S. Commodity Futures Trading Commission.

So it begs the question, why is TradFi money now flowing into crypto? SBF only just received his sentence and CZ is still awaiting his. The crypto market still has a lot of cleaning up to do since FTX's contagion-inducing collapse.

For Yap, notoriety in asset classes is nothing new. "Hedge funds were once upon a time also viewed with a certain degree of skepticism," Yap says. "Until of course they gradually became an institutional asset class and, by the 1990s, a part-and-parcel allocation in institutional portfolios."

It appears therefore to be less of crypto changing, and more of TradFi mindsets about crypto, Yap says, "Since the publication of Satoshi’s Bitcoin Whitepaper in 2008, arguably, what has changed really?"

"I wouldn't say there has been a big change in the acceptance of crypto. But rather the mindset of those who are engaged in the business of asset management has begun to shift," he adds. "Keeping an open mind is essential to becoming a better, more evolved investment manager because you're recognizing new asset classes for what they are - a source of returns, a source of risk, a source of diversification" he explains.

Yap points to a quote often attributed to economist John Maynard Keynes: “When the facts change, I change my mind. What do you do, sir?” For Yap, Keynes' words lie at the heart of what it means to be a more complete decision-maker in the field of investment management. “And this,” Yap says, “allows us to stay one step ahead of the competition.”

Looking back over the last 12-24 months, the crypto industry has undergone its largest shakeup yet - with Bitcoin prices reaching a (then) all-time high to nosediving as the industry imploded on the back of the LUNA and FTX collapses, and only to return with formidable strength as BTC exchange-traded funds were approved.

For Sygnum, the silver lining of crypto's last crash is consolidation. "The sector’s ability to separate the wheat from the chaff has been an important development," Yap says. "Be it Binance, FTX, or even locally with 3AC, the growing maturity of the sector is starting to provide assurance that regulation and infrastructure can come together to protect investors."

TradFi vs. Crypto Strategies

To some extent, the crypto asset is an entirely different beast from TradFi staples. Microsoft, the biggest listed company by market cap, shares no similarities in terms of value with the largest market cap crypto, Bitcoin. However, for Sygnum, investment strategies applied across asset classes need not necessarily differ too much.

"The principle, impetus, and objective remain the same - you want to manage your intended risk and achieve your desired risk-adjusted objective," Yap explains. "It is thus not really surprising to see some degree of similarity in implementation approaches across both TradFi and crypto. Take for example fundamental bottom-up selection - whether you're picking a company or a coin, you're doing deep-dive bottom-up research to determine the quality of its investment thesis and use case."

Quant strategies are also applicable to crypto too, according to Yap. "You can follow patterns, write algorithms, and employ behavioral calls that exist in equities, fixed income, FX, commodities, and the like, and apply them to crypto."

"What goes on in the minds of portfolio managers when they look to extract a source of return doesn't change a whole lot from TradFi to crypto," Yap states. "The principles, purposes, and applications are largely similar."

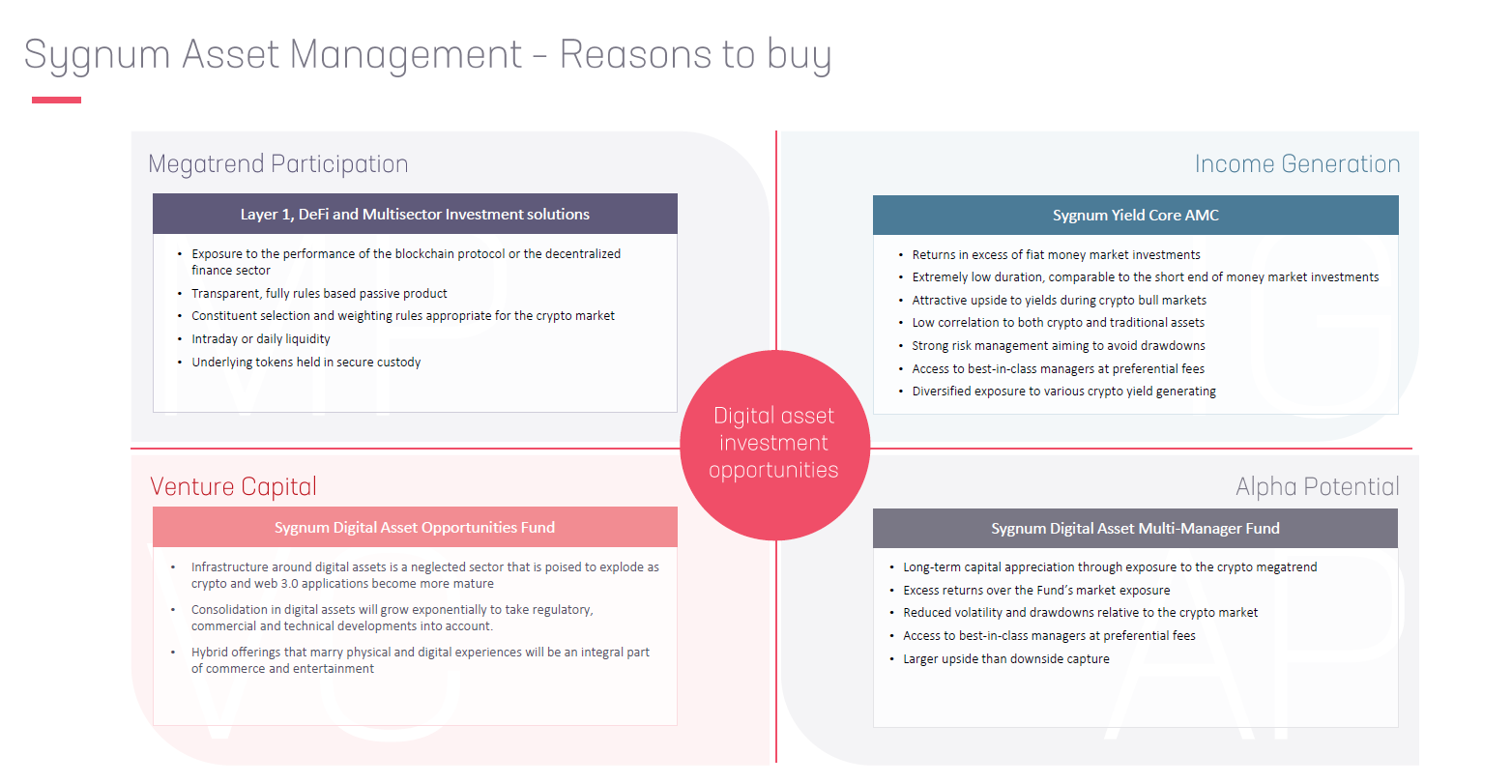

Sygnum extracts returns from crypto through these strategies: Megatrend Participation, Income Generation, Venture Capital, and Alpha Potential.

Megatrend Participation

This approach provides investors with the opportunity to invest in the fast-growing ecosystem of blockchain protocols and other emerging market segments.

Income Generation

This approach provides investors with the opportunity to invest in a diversified yield-generating portfolio through strategies like lending, funding arbitrage and liquidity provisioning.

Alpha Potential

The approach presents investors with a wide range of active strategies via a multi-manager approach.

Venture Capital

This approach presents investors with the opportunity to invest in early-stage start-ups that are building tomorrow’s ecosystem on the blockchain.

TradFi vs. Degens

Understanding clients' risk appetites is crucial to Sygnum. "When looking at tokens or the crypto hedge funds we're investing with, we want to ensure that what is being implemented follows a rigorous risk-controlled process," Yap explains.

This process is governed by proper investment guidelines and risk-taking behavior. "We don't take unnecessary or unwanted risks and in the event that such risks do appear, we know the appropriate actions to take to rectify them."

In terms of applying TradFi fundamentals to crypto, Yap points again to the nascency of the crypto industry. For Sygnum, this would involve sifting out coins or managers that do not meet their investment criteria.

"For coins, aside from market cap and liquidity, we also evaluate on qualitative factors such as real-world adoption and developer commitment," Yap says.

“We evaluate what each developer is doing and its contribution to the crypto ecosystem's growth. If these factors aren't present, even if a token seductively trades at high prices, it's not an investment for us. Knowing when to walk away, and what to walk away from, is another key element in sound risk management."

Growth Drivers

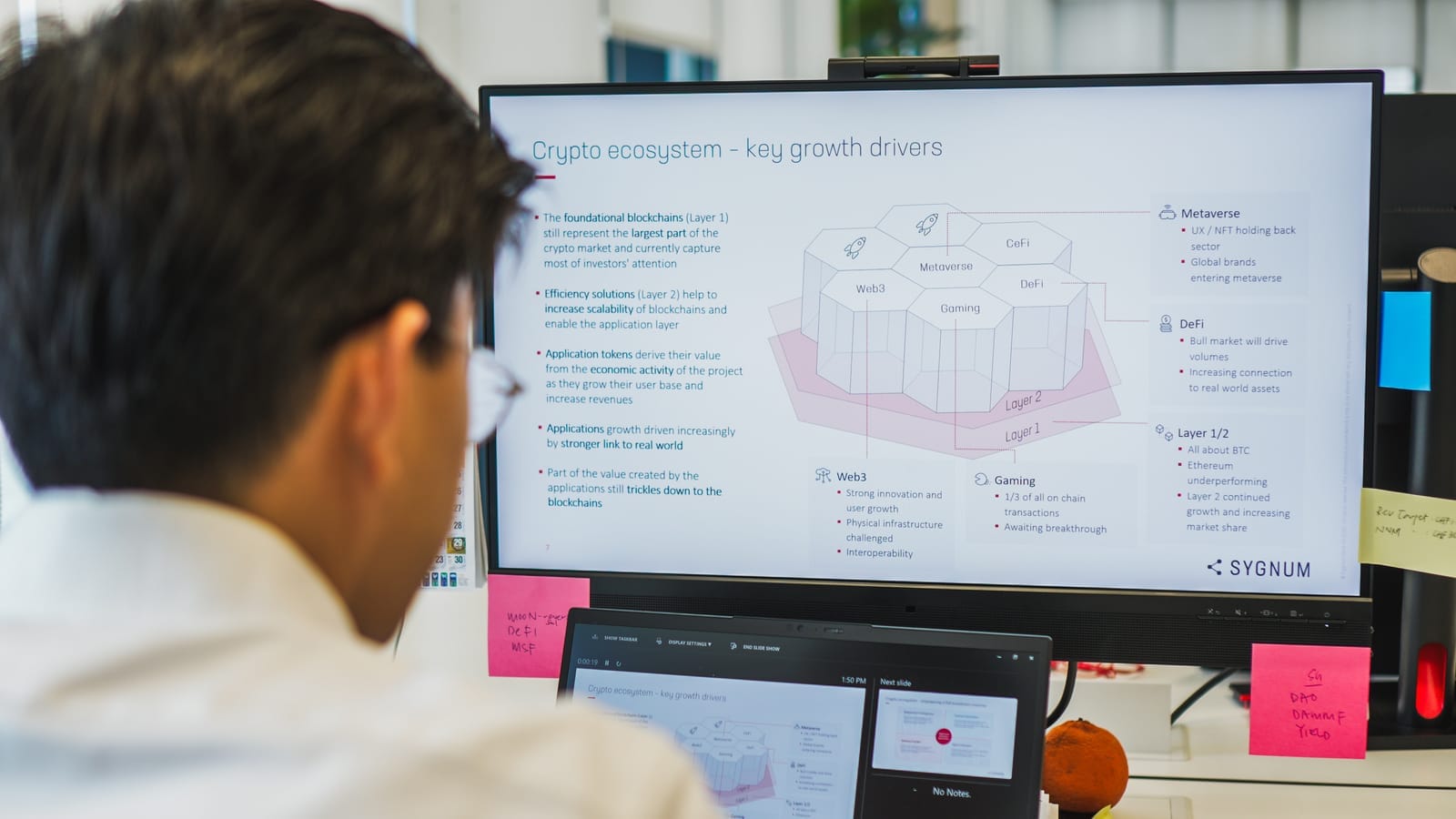

With the fast-paced environment of crypto, it's often difficult to know which horse to back. Sygnum is particularly looking at scaling up from key layer 1 tokens.

"Applications come after the layer 1 and layer 2 infrastructure protocols," Yap explains. "So where are the next opportunities out there in Web3, Gaming, DeFi or Metaverse? These form the next inflection point in terms of growth in the sector."

Reflecting on recent events, Yap notes how there has been a "desire from the man on the street to get exposure to crypto but not having to go to coin ownership level" since the approval of Bitcoin ETFs by the SEC.

“The creation of the ETF vehicle democratizes crypto ownership," he adds. "ETFs are very commonly used in the institutional world. They offer exposure to the traditional asset classes, and now we have it for Bitcoin without having to worry about hot wallets and cold wallets. The fear of losing one's password has been put to sleep by virtue of these ETFs."

Nonetheless, Sygnum wants to push further than trend participation by offering investors a source of income, alpha, and the ability to be ahead of the curve in crypto’s development. The firm's reputation is therefore critical for clients.

"We meet stringent regulatory standards in Switzerland and Singapore," Yap says. "This establishes that necessary degree of trust between our clients and us. "

"The Sygnum Asset Management offering is not here to punt on rallies or make short-term price predictions. We're focused on long-term investing, employing a repeatable, disciplined process across market cycles, all while keeping that deliberate focus on our clients’ desired investment goals and outcomes."

Hey there! Just a quick note to let you know that this article is brought to you by Sygnum. Sygnum is a global digital asset banking group, founded on Swiss and Singapore heritage. They empower professional and institutional investors, banks, corporates and DLT foundations to invest in digital assets with complete trust. The team enables this through our institutional-grade security, expert personal service, and portfolio of regulated digital asset banking, asset management, tokenization, and B2B services.

In Switzerland, Sygnum holds a banking license. In Singapore, it has the Capital Markets Services and Major Payment Institution licenses. The group is also regulated in the established global financial hubs of Abu Dhabi and Luxembourg.. So, please sit back, relax, and enjoy today's news, knowing that it's made possible by our friends at Sygnum.