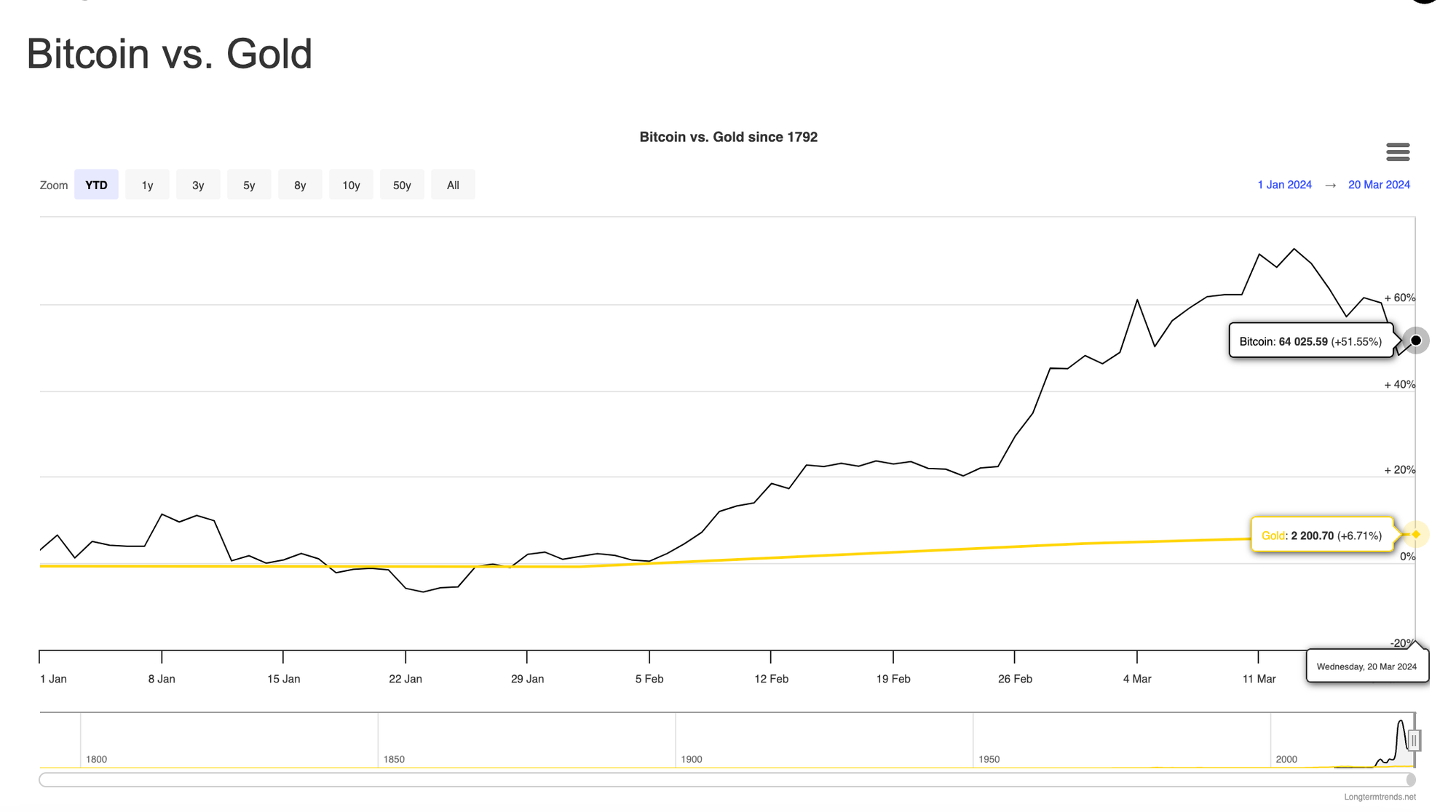

The directly proportional correlation between Bitcoin and gold in the recent rally, during which both assets have surged to record highs, is surprising and sending mixed signals about global investors' risk appetite.

For the first time in over a decade, cryptocurrency and precious metals are experiencing simultaneous increases, marking a significant milestone since Bitcoin's emergence from obscurity.

Bitcoin soared to a record high of over $73,000 earlier this month, surpassing its previous life high of around $69,000 in November 2021.

Gold hit an all-time high of above $2,200 an ounce for the first time on Wednesday after the Federal Reserve kept its prediction of three rate cuts for this year, even though inflation has recently risen.