Table of Contents

We've been avoiding the elephant in the room for a while now. After a burst of spot Bitcoin ETF updates at the start of the year, we took a break from laboring about the "revolutionary" financial products. Not because we're too cool for school but because Bitcoin ETF news quickly became repetitive, dry, and let's be honest, predictable.

More importantly, the world of digital assets and Web3 extends far beyond Bitcoin. It was our duty to dig out industry trinkets and uncover any hidden gems that were buried beneath the Bitcoin ETF coverage. We'd like to think we found some for you. You're welcome.

We're now revisiting the Bitcoin scene as there have been some new developments that we probably shouldn't overlook.

Before we set the ball rolling, and for consistency's sake, a little on Bitcoin's price: BTC has traded relatively sidewise after breaking the $52K barrier. Our in-house analyst believes it could soon hit $55K.

1,000% Boost

VaneEck's spot Bitcoin ETF, also known as HODL, has seen its daily volume exceed $300 million. The figure represents a 1000% increase from its previous peak.

Interestingly, the surge was not a result of one or two whales but due to 32,000 individual transactions, marking a 60x increase from its average.

The pump has left Bloomberg ETF expert, Eric Balchunas, bewildered. "Still haven't figured out what happened. No one knows," Balchunas tweeted, adding that it could even be social media driven.

"Given how sudden and explosive the increase in number of trades was (500 trades Friday, 50,000 trades today) I'm wondering if some Reddit or TikTok influencer type recommended them to their followers. Feels retail army-ish."

Still haven't figured out what happened. No one knows. Given how sudden and explosive the increase in number of trades was (500 trades Friday, 50,000 trades today) I'm wondering if some Reddit or TikTok influencer type recommended them to their followers. Feels retail army-ish. https://t.co/WazxSSgFjR

— Eric Balchunas (@EricBalchunas) February 20, 2024

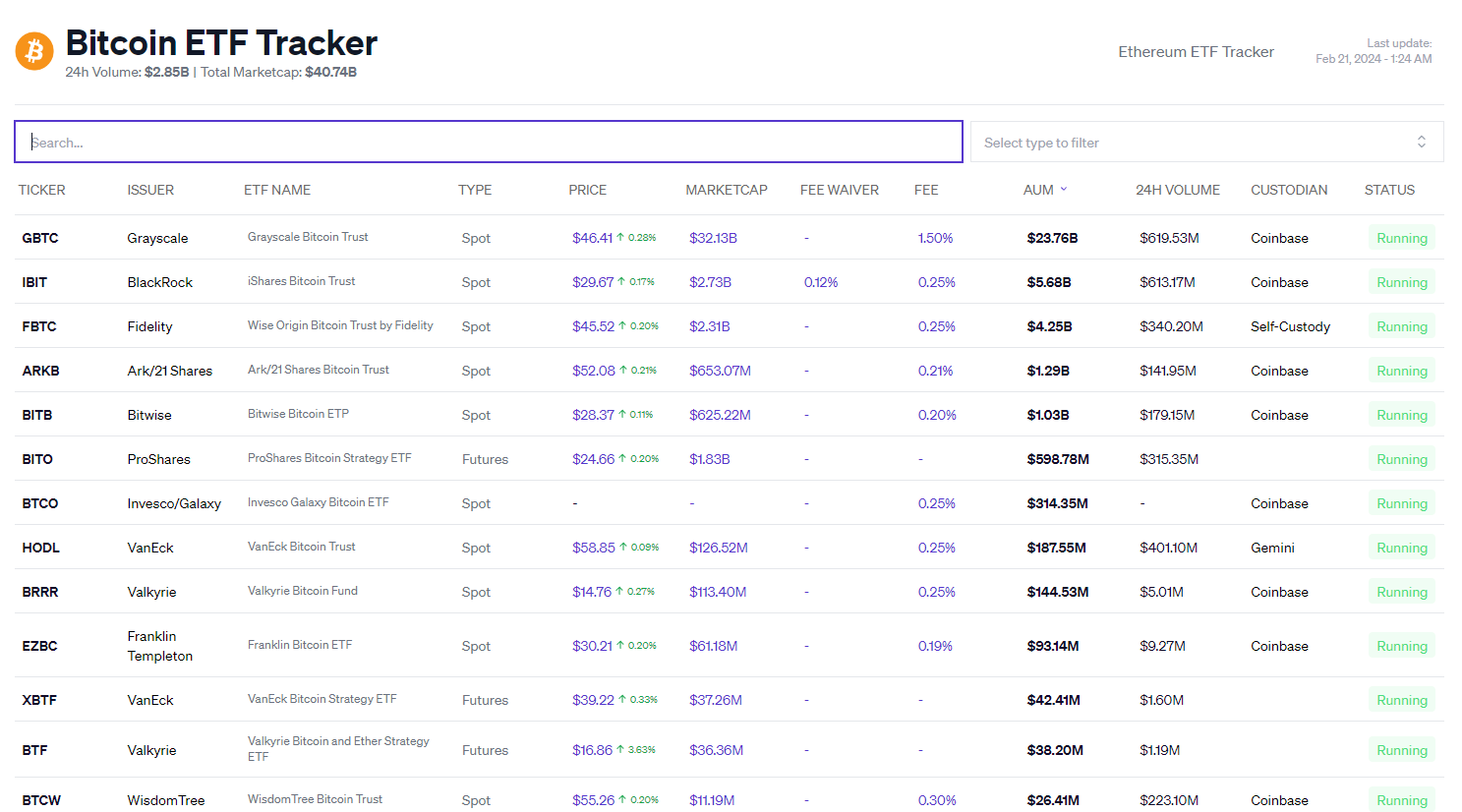

Until recently, VanEck's Bitcoin ETF has been outperformed by its rivals. Grayscale's $23.76 billion and BlackRock's $5.68 billion dwarf VanEck's $187.55 million.

However, VanEck's 24-hour volume of $401.1 million casts a shadow on Fidelity, Ark, and Bitwise, which have only seen $340.2 million, $141.95, and $179.15 million over the same period despite having AUMs over one billion.

In response to the swing, VanEck's head of ETF products, Ed Lopez said, "Because ETFs trade on the secondary market, it can be challenging to know who or why someone buys an ETF. Today’s trading has sported great volume at tight spreads, which is ultimately what you’d want from an ETF, whether you're bullish or bearish on the market."

Last week, VanEeck filed a notice with the SEC that it would lower its fee from 0.25% to 0.20%, effective tomorrow, 22 February.

Not Just VanEck

VanEck isn't the only fund that has a 24-hour volume higher than its AUM. WisdomTree has seen $223.10 million in volume over the 24-hour period despite having AUM of just $26.41.

"Typically when the daily volume is greater than an ETF's total assets (as in this case) it means one big creation," Balchunas explains. "I've never seen a grassroots trading explosion come out of nowhere like this."

More interesting-ness: $BTCW also popping off, $154m trades, 12x its avg and 25x its assets via 23,000 indiv trades. For context, it saw a mere 221 trades on Friday. At the same time $IBIT volume is elevated but not crazy like this. WTF? ETF Unsolved Mysteries will continue after… pic.twitter.com/IXQmCKuCWl

— Eric Balchunas (@EricBalchunas) February 20, 2024

Volumes in Bitcoin ETFs have amounted to almost $2 billion, which is the highest since its first day of trading back in January.

The Nine had biggest volume day since Day One with about $2b in combined trading thx to big contributions from $HODL, $BTCW and $BITB which all broke their personal records. For context $2b in trading would put them in Top 10ish among ETFs and Top 20ish among stocks. It's a lot. pic.twitter.com/547pIl5grI

— Eric Balchunas (@EricBalchunas) February 20, 2024

Liquidity Pump

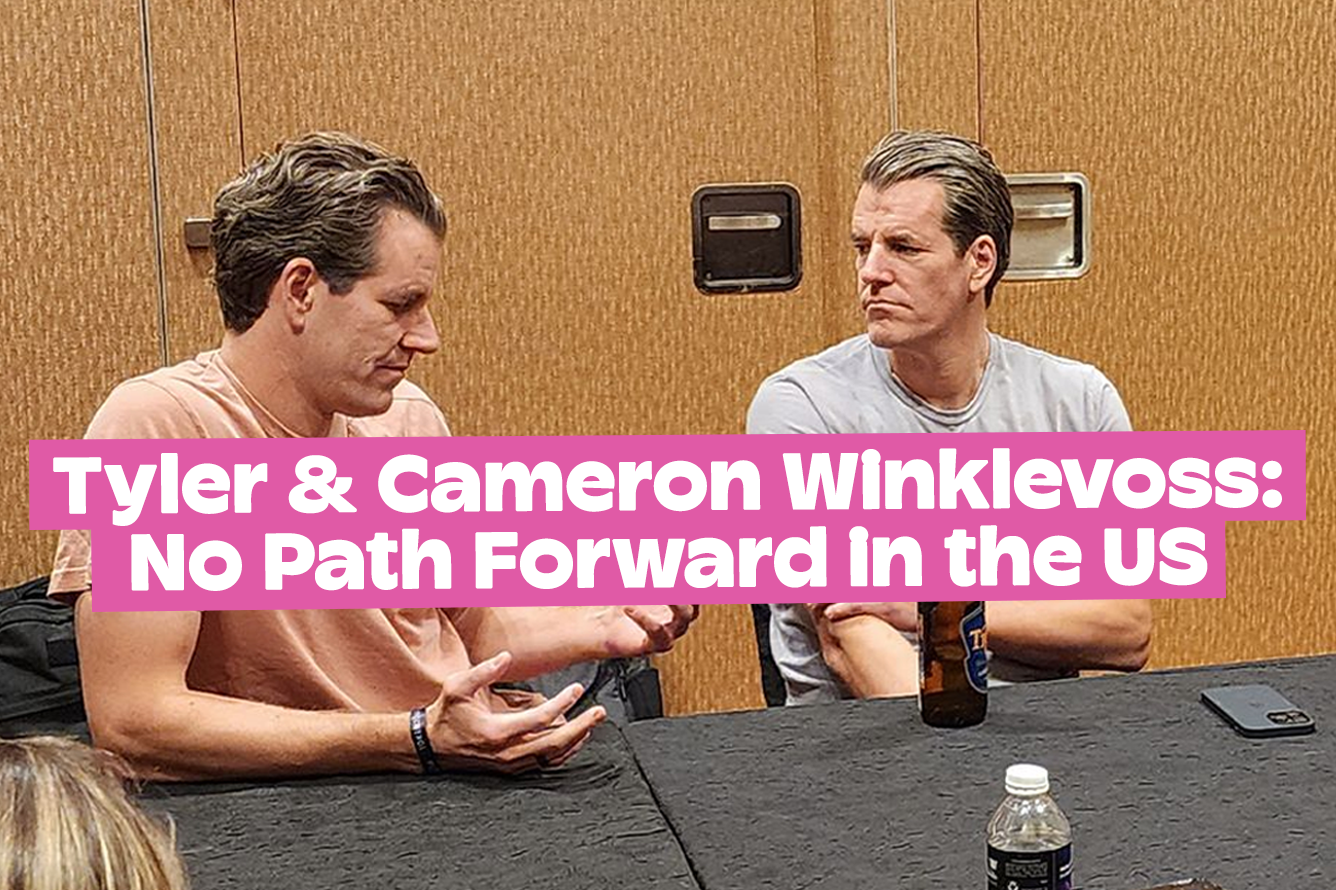

Before the official approval of Bitcoin ETFs, Gemini co-founder Tyler Winklevoss, told Blockhead that the most exciting aspect of onboarding institutions is liquidity. "I think the next wave will be ETFs and that's going to bring a ton of liquidity and price discovery," Tyler explained.

"We have many institutional customers, and they range from proprietary trading firms to large macro hedge funds," he continued. "And I think we're going to see 10x that once ETFs arrive."

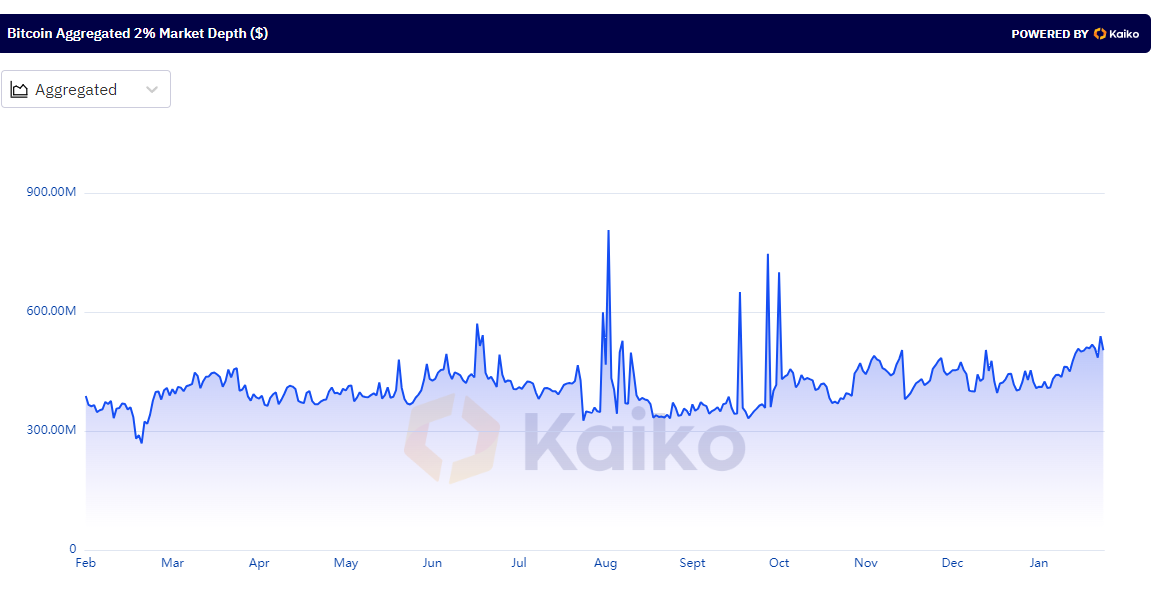

True enough, Bitcoin order books are now the most liquid since October 2023. Bitcoin's 2% market depth across 33 centralized exchanges has risen to $539 million.

Bitcoin's 2% market depth measures the aggregated bids and asks on BTC order books and is up 23% since the end of November and by 30% year-over-year to $485mn.

"The increase in liquidity has been driven by U.S. platforms and is likely linked to the spot ETF approvals," Kaiko explains. "The market share of BTC market depth on U.S. vs. global exchanges has increased consistently since November, exceeding 50% since late 2023."

Greater liquidity means easier access and less slippage between trading prices.

Sail on, Saylor

Bitcoin super bull Michael Saylor believes the cryptocurrency spot ETFs are yet another reason to stay long. The MicroStrategy CEO said, "The spot ETFs have opened up a gateway for institutional capital to flow into the Bitcoin ecosystem."

"[The ETFs] are facilitating the digital transformation of capital, and every day hundreds of millions of dollars of capital is flowing from the traditional analog ecosystem into the digital economy."

MicroStrategy bought another 16,130 BTC in December, totaling a balance of 190,000 Bitcoin in January. Saylor isn't intending on selling any of it.

MicroStrategy has acquired an additional 16,130 BTC for ~$593.3 million at an average price of $36,785 per #bitcoin. As of 11/29/23, @MicroStrategy now hodls 174,530 $BTC acquired for ~$5.28 billion at an average price of $30,252 per bitcoin. $MSTR https://t.co/hSEZyzGBsr

— Michael Saylor⚡️ (@saylor) November 30, 2023

“I’m going to be buying the top forever, Bitcoin is the exit strategy," he explained, adding that the cryptocurrency is stronger than gold. “We believe capital is going to keep flowing from those asset classes into Bitcoin because Bitcoin is technically superior to those asset classes and that being the case, there’s just no reason to sell the winner and to buy the losers.”

Elsewhere