Table of Contents

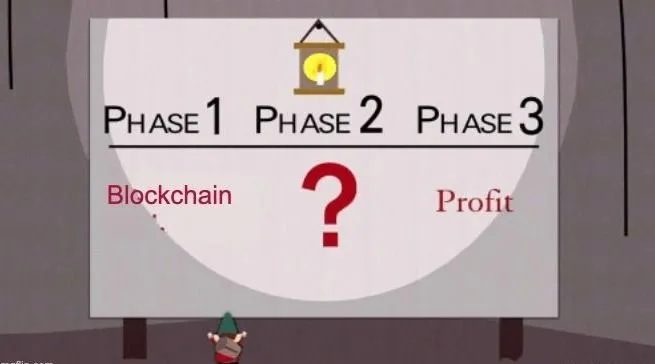

In the ever-evolving world of digital assets and technology, it's crucial to have tools that allow us to gauge the potential and profitability of new innovations. Enter the Years-to-Profitability (YTP) metric, a fresh perspective that's reshaping how we evaluate the promise of Layer-1 (L1) blockchains.

This article was prepared in collaboration with Franklin Templeton Digital Assets.

The Evolution of Blockchain Metrics

In the nascent days of blockchain technology, the realm was simpler, and so were the metrics. Market capitalization (market cap) and daily transaction volume stood out as the primary indicators to gauge the health and potential of a digital asset.

These metrics, mirroring traditional financial markers, provided a familiar touchstone in a rapidly growing and often chaotic crypto landscape. However, as blockchains matured and diversified, these initial measures started showing their limitations. Enter YTP—a forward-looking metric, an evolution born out of the need to evaluate blockchains with a perspective that balances both present dynamics and future potentials.

Current Landscape: How are L1s Evaluated?

Traditional evaluation of businesses and investments often leans on metrics like price-to-earnings or price-to-sales ratios. In the context of L1 blockchains, similar metrics have been adapted to assess the value and potential of these digital systems.

Investors have typically considered factors such as the immediate price of the digital asset, its historical performance, market demand, and the underlying technology's perceived strength.

But while current metrics provide insights, they have shortcomings in the blockchain realm:

- Short-term Focus: Traditional metrics can be reactive, often emphasizing recent performance or immediate market sentiments. This short-term vision can overlook the long-term potential or stability of a blockchain.

- Overlooking Token Dynamics: L1 blockchains have inherent programmability, meaning factors like token emissions, staking rewards, and burn rates can significantly influence the blockchain's value and sustainability. Traditional metrics might not fully capture these dynamics.

- Lack of Forward Vision: Many current metrics lack the ability to project into the future, particularly in terms of profitability and growth.

What is YTP?

YTP endeavors to address the above limitations. In essence, YTP seeks to estimate the timeline for a particular L1 blockchain to become profitable. Rather than focusing solely on current values or historical data, YTP offers a forward-looking perspective, blending traditional financial wisdom with crypto-specific dynamics.

YTP views each blockchain as a unique business model. It earns through transaction fees (revenues) and incurs costs for ensuring network security. By analyzing current operations and anticipating future trends and growth, YTP predicts when this 'business' will attain a break-even point and then transition into profitability.

Why YTP Matters

- Bridging Two Worlds: YTP merges classical financial evaluation principles with the unique nuances of the crypto domain, offering a metric that's both intuitive and specifically tailored for blockchains.

- Holistic View: Beyond immediate market sentiments or current token prices, YTP offers a broader view of a blockchain's sustainability and long-term profitability.

Blockchain analysts and enthusiasts have been quick to weigh in on the significance of the YTP. In a recent report by Franklin Templeton, authors David Alderman and Chris Jensen state, "YTP serves as a crucial metric in evaluating the profitability and sustainability of L1 blockchains. By carefully designing tokenomics (inflationary or max supply), balancing supply dynamics and incorporating burn mechanics, L1 blockchains can aim to reduce YTP and build a more sustainable blockchain economy.

Case Studies: YTP in Action

YTP brings several benefits when evaluating Layer-1s:

- Comparative Analysis: Beyond individual evaluations, YTP can juxtapose multiple blockchains, allowing side-by-side comparisons.

- Dynamic Adjustability: YTP isn't static. As blockchains evolve and new data emerges, YTP can adjust, ensuring its relevance in a rapidly changing crypto landscape.

To bring YTP into sharper focus, let's look at a few real-world examples:

- Ethereum (ETH): Once purely seen through its impressive market cap and adoption rate, Ethereum's shift towards Ethereum 2.0 and staking brought to light the importance of token dynamics and emissions. Using YTP, one could evaluate Ethereum's profitability horizon in the context of these new changes.

- Cardano (ADA): A blockchain that boasts a unique peer-reviewed approach to development. While traditional metrics might showcase its growing adoption and stable price, YTP provides insights into when Cardano might become sustainably profitable, given its tokenomics and growth strategies.

These examples underscore the tangible benefits of YTP, which offers a more comprehensive view than traditional metrics.

Comparison with Traditional Markets

In traditional stock markets, businesses are often evaluated based on their earnings, assets, liabilities, and growth potential. Price-to-earnings ratios, for instance, offer a glimpse into a company's profitability relative to its stock price. However, the crypto world, with its decentralized nature, token dynamics, and rapidly evolving technology, poses unique challenges.

While traditional metrics serve well in stable, well-established markets, the dynamic and innovative world of blockchains requires a more nuanced approach. YTP stands out in this regard. It not only takes into account the present performance and value of a blockchain but also its future token emissions, staking rewards, and growth potential. This holistic perspective makes YTP a particularly powerful tool in the crypto evaluation toolkit, bridging the gap between traditional financial wisdom and the pioneering world of blockchains.

Summary

As the digital assets space burgeons with promise, tools like YTP illuminate the path, ensuring our navigation is informed, strategic, and visionary. It's about both understanding the present state of L1 blockchains and charting their promising journeys ahead.

Those with a keen interest in diving deeper into the intricacies of YTP can explore more detailed resources here.