Table of Contents

Layer 1 blockchain Aptos has been the talk of the town this month, with its native token APT skyrocketing over 450% 0ver this period.

On Thursday, APT reached an all time high of US$19.60, following an ongoing rally experience throughout the month.

Surprisingly, there have been no announcements or changes from the Aptos team to drive this pump. Instead, hype surrounding the token has been one of its key drivers.

That's not to say that the project's attention thus far is unsubstantiated. After all, Aptos is backed by some serious players in the crypto industry including A16, Circle, Dragonfly Capital, Binance Labs, Jump Capital and FTX (lol).

Read more: SBF Denies Stealing Funds in “FTX Pre-Mortem Overview"

Not only do these big investors need to increase the hype on Aptos, but a Layer 1 blockchain with such backers will undoubtedly garner attention from the wider market.

Pancakes & NFTs

Whilst there haven't been any new announcements from Aptos's side, the blockchain is proving popular with developers.

PancakeSwap, which accounts for over 50% of the TVL on the Aptos chain, recently presented a proposal that it would intensify development on Aptos.

The decentralised platform proposed it would:

- "Aim to get further visibility within the Aptos ecosystem to attract additional Aptos-based projects to deploy on PancakeSwap"

- "Aim to get further visibility within the Aptos ecosystem to attract additional Aptos-based projects to deploy on PancakeSwap"

- Look into leveraging "its strength on BNB Chain to attract Aptos-based projects to BNB Chain and vice-versa, so as to improve CAKE burn."

Simultaneously, NFTs built on Aptos are becoming increasingly popular. Topaz marketplace has experienced volume surges as of recent.

In particular, CryptoPunks inspired project AptoPunks, and NFT series BabyApetos reportedly saw increases of 2,577.2% and 3,260.82% in 24 hours earlier this week.

Korean Red Flag

With sizeable investors behind it, and developers flocking to it in volumes, Aptos is beginning to prove its worth. However, is this enough to drive its 450%+ price surge, especially considering its lack of new announcements?

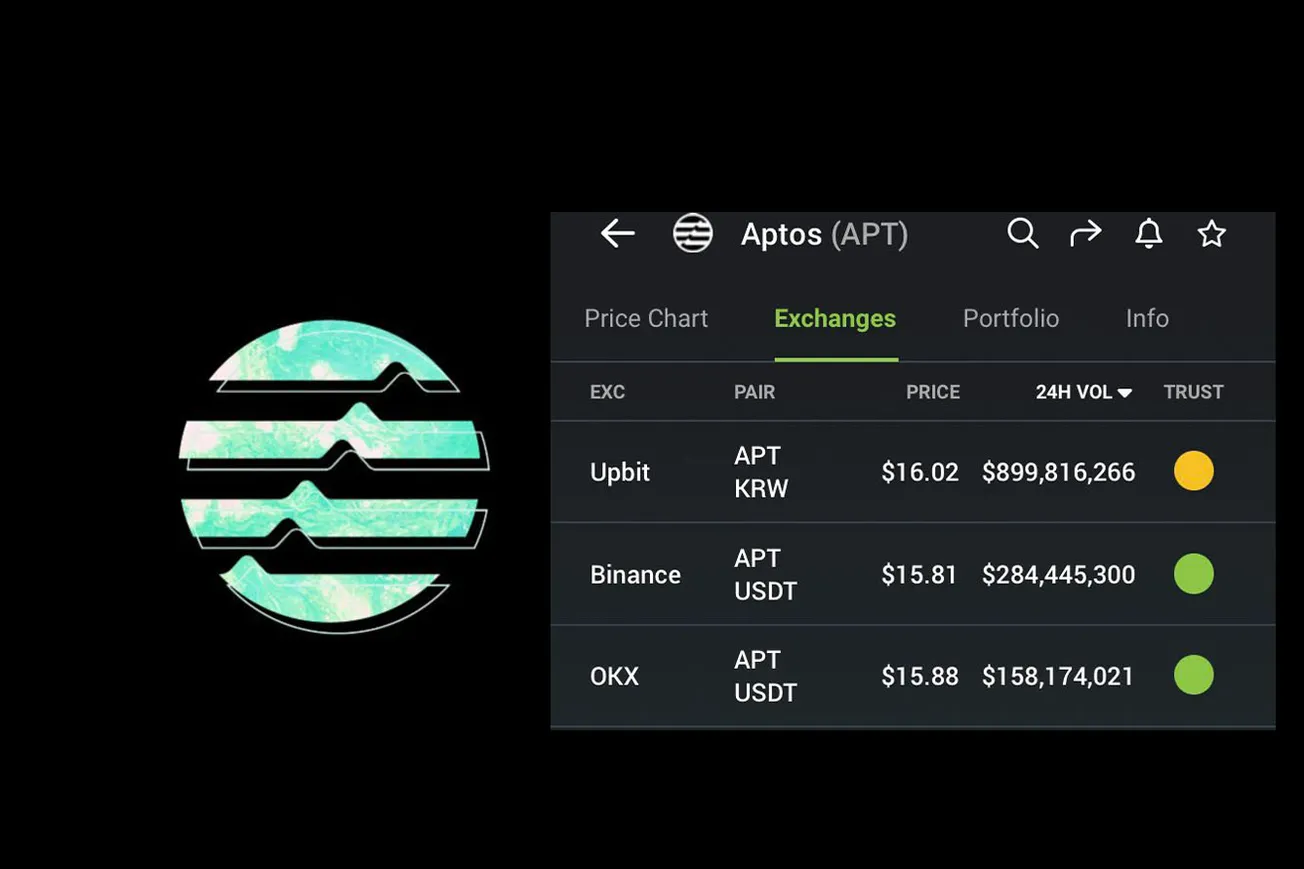

Crypto Twitter warns that there could be more than meets the eye. As one Twitter user points out, APT has 3x the trading volume on Korean exchange Upbit compared to the world's biggest crypto exchange Binance.

Read more: Cronje Says "No Announcement," So What's Behind the FTM Surge?

"Aptos is heavily manipulated," Twitter user @healthymofin writes.

"Aptos' Korean strategy is spot on. Look at the volume at Upbit," another writes.

Aptos is heavily manipulated… Upbit (Korean Exchange). $APT volume is 3x of Binance volume 🤯🤯 Be careful pic.twitter.com/uO801LCUtD

— Kool Crypto (💙,🧡) ⚙️🛸 (@healthymofin) January 25, 2023

Today Korea Upbit

— DoJang (@cryptojangDo) January 25, 2023

- $APT is in top3 with $T and $NU

- And Aptos upbit volume is much bigger than @binance and @Bybit_Official

- Personally when NU is top in upbit. It was a warning sign. I just observe market with patience.

- Intetesting Korea am session. pic.twitter.com/DIPkq2aNxh

@Aptos_Network ’s Korean strategy is spot on. Look at the volume at Upbit. pic.twitter.com/Ade43caHGj

— Irvingpapa (@thetayyy109) January 21, 2023

The theory becomes even more intriguing when digging into Upbit's shady history. In 2018, South Korean regulators indicted three of its employees for alleged market manipulation. One year later, a petition was filed to investigate Upbit for manipulating crypto prices.

As recently as 2021, South Korean lawmaker Yun Chang-hyun claimed the Financial Services Commission (FSC) gave the Upbit privilege in meeting government requirements.

“[The FSC] postponed Upbit’s start date of its KYC obligations to Oct. 6,” Yun said at the annual National Assembly, adding that the FSC was more lenient towards Upbit. “Isn’t this special treatment [towards Upbit]?”

Koreans filed a petition with to investigate Upbit.

— TheNews.Asia (더뉴스아시아) (@TheNewsDotAsia) November 28, 2019

They believe Upbit manipulated #Crypto prices and want retribution.

In Korea, you need 200k signatures to force the president to act on a petition.....@upbitglobal #bitcoin pic.twitter.com/bp4ItBEzqU

Of course, there's no concrete evidence to prove that anything fishy is actually occurring, but Upbit outsizing Binance is suspicious enough for traders to be cautious, and certainly questions whether APT can sustain its remarkable price growth.