Table of Contents

Hong Kong's financial watchdog will aim to restrict retail trading to a select group of cryptocurrencies, according a report by Reuters on Wednesday. Retail access to cryptocurrencies was previously banned in 2021.

Speaking at the Asia Financial Forum in Hong Kong on Wednesday, Julia Leung, the newly appointed CEO of the Securities and Futures Commission (SFC), said that only assets with "deep liquidity" will be made available to retail investors.

“Some virtual assets platforms have over 2,000 products, but we do not plan to allow retail investors to trade in all of them. We will set the criteria that would allow retail investors to [only] trade in major virtual assets," Leung said.

On Wednesday, the Hong Kong SAR government passed a new licensing regime for virtual asset service providers that will subject them to the same Anti-Money Laundering (AML) and Counter Terrorist Financing (CTF) legislations that traditional finance institutions adhere to.

“We aim to have a proper regulatory framework to safeguard the interest of all investors and to enhance Hong Kong as a virtual asset hub,” Leung said, adding that the an "FTX-type" collapse will not happen in Hong Kong if there are "proper regulations" in place.

Crypto hub status

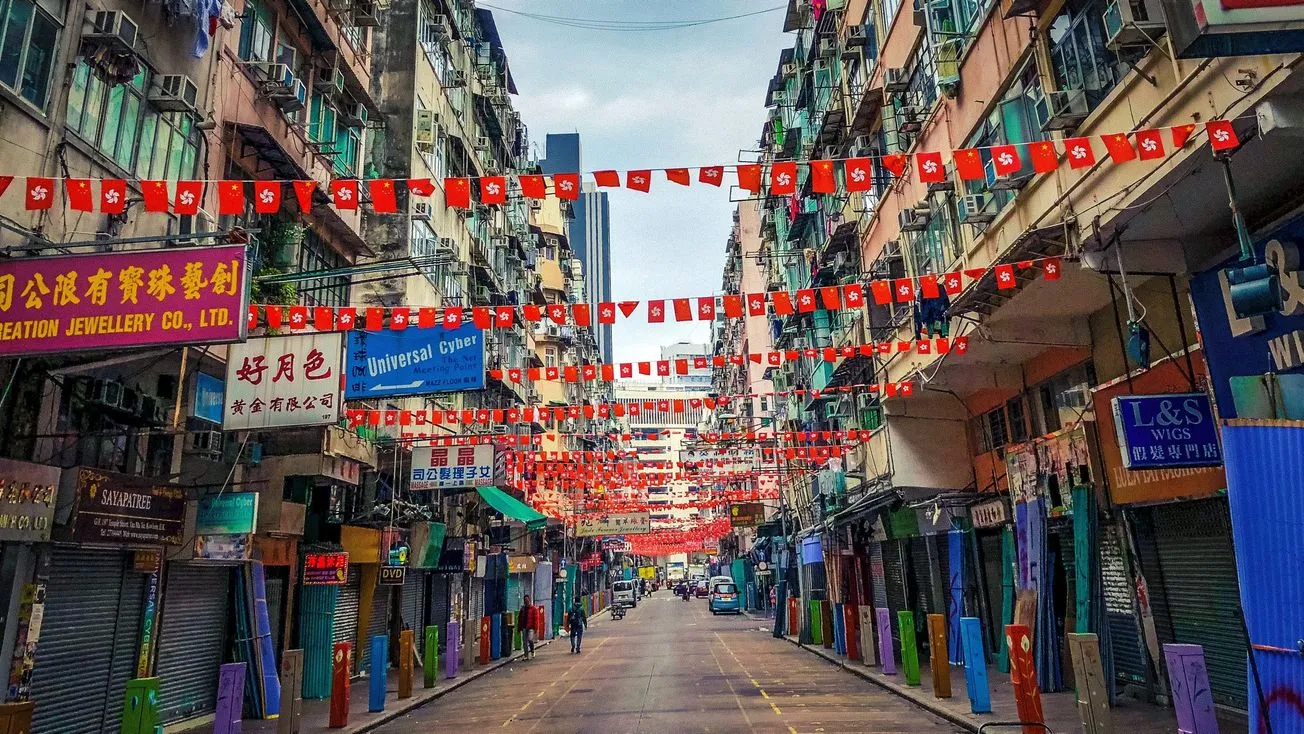

Hong Kong is continuing its push to cement its status as a regional crypto hub.

On Monday, the Hong Kong SAR government announced that it will be issuing the world's first tokenized government green bonds by the end of 2023.

In an interview with CoinDesk, Christopher Hui, secretary for the Financial Services and the Treasury of Hong Kong, said that he's "most excited" about the tokenization of green bonds, which will simplify the process of issuance and investment.

Hui also said that the "blocks are ready" to build the ecosystem, and that the city has a "more solid footing", especially given the fact that the China Securities Regulatory Commission is hoping to launch a public consultation in early 2023.

“Hong Kong is a very open place. Whoever meets our law and requirements, they’re welcome," Hui said.

Last month, it was reported that three asset management companies – CSOP Asset Management, Samsung Asset Management, and Mirae Asset Global Investments – applied with the SFC to launch ETFs (exchange-traded funds) tracking cryptocurrency futures.