Table of Contents

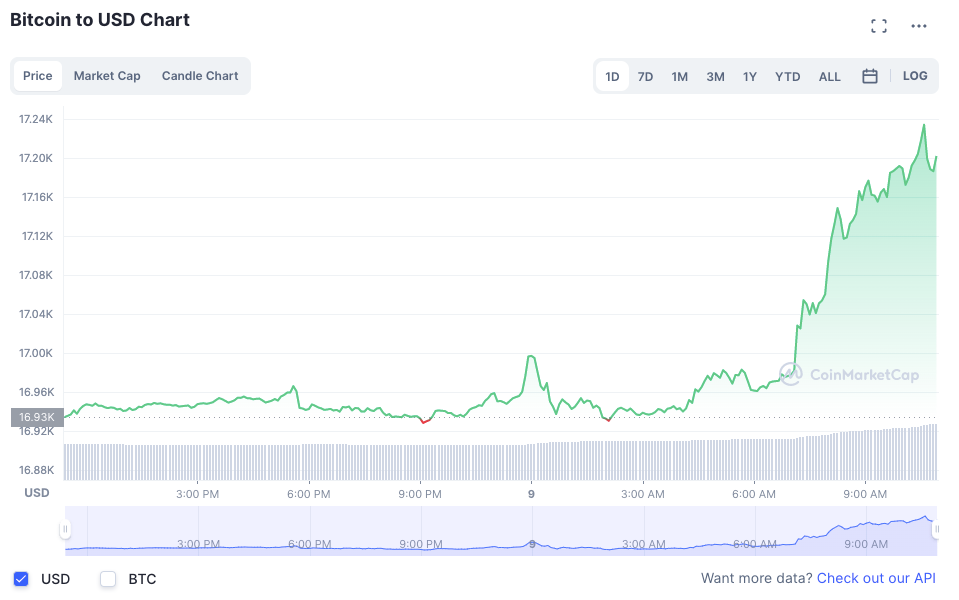

The crypto market is seemingly enjoying a mini rally, as investors place a hopeful bet on a slowdown of rate hikes by the US Federal Reserve.

At the time of writing, Bitcoin (BTC) is trading at US$17,220.64 (+1.64%) while Ethereum (ETH) is trading at US$1,310.82 (+3.80%). Major altcoins such as BNB, Polkadot (DOT), and Avalanche (AVAX) have also been trading in green within the same period.

The broader financial markets also inched higher despite a stronger-than-expected job report. US equities enjoyed 2023's first major market rally on Friday, with the S&P 500 and the tech-heavy Nasdaq Composite gaining 2.28% and 2.56% respectively.

Investors are now looking ahead to December's consumer price index (CPI) report due on Thursday, which is forecast to show annual inflation slowing to a 15-month low of 6.5% and the core rate falling to 5.7%.

All eyes on Huobi

The crypto community is raising doubts over Huobi's financial health.

Last week, it was reported that Tron founder and Huobi advisor Justin Sun told employees that the exchange would be paying salaries in USDT/USDC instead of fiat, and employees who are unable to accept this change in policy may be dismissed. Huobi also reportedly shut down internal employee communication groups and feedback channels due to a rumoured rebellion within the company.

Justin Sun's HR is communicating with all Huobi employees to change the salary form from fiat currency to USDT/USDC; employees who cannot accept it may be dismissed. The move sparked protests from some employees. Exclusive https://t.co/QB4sjDyHc7

— Wu Blockchain (@WuBlockchain) January 4, 2023

On Friday, Tron's native token, TRX, tumbled nearly 8% over 24 hours, according to data from CoinGecko. Huobi’s native HT exchange tokens also lost nearly 11% of its value before rebounding over the weekend.

Sun has attempted to allay fears in recent days, stating that Huobi's strategy remains to be "Ignore the FUD and Keep Building". and that users' funds remain "safe."

At @HuobiGlobal, we believe that the key to success in the world of cryptocurrency is to "Ignore FUD and Keep Building."

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) January 6, 2023

However, Sun transferred US$100 million in stablecoins to Huobi amid the wave of withdrawals last week. On Friday, data from blockchain analytics firm Nansen showed that Huobi recorded US$60 million in fund outflows within 24 hours.

"It just shows the confidence to Huobi exchange," Sun said in a telegram message, adding that the transfer were "just my personal funds."

In October, Huobi was acquired by About Capital Management, a Hong Kong-based asset management firm in which Sun is a major investor.

DOJ probes DCG

Crypto conglomerate Digital Currency Group (DCG) is under investigation by the US Department of Justice (DOJ) and the Securities Exchange Commission (SEC).

According to a Bloomberg, US authorities are reportedly looking transfers between DCG and subsidiary Genesis.

Genesis is currently embroiled in a dispute with crypto exchange Gemeni – it owes users of the Gemini Earn program some US$900 million. It was the program's exclusive yield source and sent a lot of those funds on to DCG, which bought some mixture of GBTC and DCG stock.

Earlier this week, Cameron Winklevoss, co-founder of Gemini, wrote an open letter earlier this week to Barry Silbert, chief executive of DCG, Genesis's parent company, accusing him of “bad faith stalling tactics,” claiming that DCG owes Gemini a total of US$1.675 billion.

Genesis has laid off almost a third of its workforce, which now stands at 145 employees. The cuts come just a day after Genesis sent a letter to clients, saying that it needs more time to come up with a solution for the troubles at its lending unit and that it would be “reducing costs and driving efficiencies,” citing the challenging climate for crypto firms.

Read more: Genesis Trims Workforce By 30% in New Layoff Round

In August, the company let go of 20% of its employees, after announcing major losses linked to the 3AC fallout – US$1.2 billion is claimed against the now defunct hedge fund. Digital Currency Group had assumed some of its liabilities.

Genesis also revealed that it was exposed to FTX by at least US$175 million, via its derivatives trading business.

Singaporean arbitrator rules against Poolin

Embattled crypto mining software firm Poolin has been ordered by an independent arbitrator in Singapore to return 88 BTC (worth approximately US$1.5 million at the time of writing) to a customer whose crypto were converted to IOU tokens. The order is pending approval by an arbitration tribunal.

In September, Poolin Wallet suspended withdrawals after announcing in a blog post that it was experiencing a liquidity crunch. The firm subsequently told customers that their funds would instead be converted to IOU tokens, which could be converted back to crypto every three months.

Statistics show that Poolin has issued about $238 million in "bond tokens" IOUTOKEN, including 8,400 IOUBTC, 31,900 IOUETH, 30 million IOUUSDT, 23.7 million IOUDOGE, and 21,900 IOUZEC. https://t.co/973P0sjaIz pic.twitter.com/pzP3UUh3Wt

— Wu Blockchain (@WuBlockchain) September 20, 2022

According to crypto journalist Colin Wu, Poolin has distributed US$238 million of said IOU tokens. However, after the firm announced that some balances would be paid out at the end of December, some the firm's customers have said that they did not received the tokens as promised.

The company has said that it expects to pay out the balances in full within 1-2 years, as only 10%-20% of each account balance will be paid out per quarter.

According to data from BTC.com, Poolin's mining pool has a 2.63% share of the total hashrate of Bitcoin.

Trading Volume

According to data from CoinMarketCap, the global crypto market capitalization currently stands at US$848.24 billion, a 3.13% increase since yesterday. The total crypto market trading volume over the last 24 hours is US$27.79 billion, a 62.78% increase.

Fear & Greed Index

Risk appetites in crypto remain sapped – the Crypto Fear and Greed Index currently stands at 25, indicating “ fear". The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.