Table of Contents

This column explores cryptocurrency markets from the perspective of a somewhat-grizzled trading veteran with a quantitative background and perhaps too much experience doing derivatives janitorial work. Finance is an old industry with a long history of everything from productive innovation to cartoonish fraud. Here we take a grand skeptical tour of a new corner of that world, with two tools that have consistently helped traders for millennia in our steamer trunk: math and knowledge of the past.

Stablecoins are a big thing in crypto. And there is a lot of debate over precisely what these things are good for. But one thing they are definitely good for – so long as your coins don’t get frozen – is moving money around freely. What is a stablecoin that serves more as a conduit for, rather than a store of, value? That’s a new use case.

Huobi & Paxos

Huobi’s HUSD recently wobbled off it’s peg quite a bit. And there are real questions about what is happening at Huobi in general. But many people did not know Paxos used to run Huobi’s stablecoin (HUSD). Huobi talked about this a few times as well. And Paxos has their own stablecoin with some interesting characteristics.

The Paxos USD, formerly PAX, is a well-respected stablecoin. It’s NY DFS regulated and nobody really questions the USD are there. They’ve provided monthly attestations for years, signed by a NY-based auditing firm. And lately they’ve even given precise reserve breakdowns. Their client list includes quite a few large traditional banks and brokers (including one of my former employers). Paxos look fine by traditional finance standards and positively saintly by crypto standards. Huobi is a Seychelles-based crypto exchange founded in China. Yeah.

Oddness

Now to be fair there is a little more oddness. After about two years the relationship ended and Huobi transferred their stablecoin over to their own trust company. That is all fine as far as it goes.

The USDP market cap chart on CoinMarketCap looks innocuous enough:

But things are not quite what they appear. See that flat bit in the middle? USDP experienced hundreds of millions of dollars in token minting and burning during that period, but near-0 net market cap change. And across the whole range, the token gained about US$1 billion in market cap, but over US$7 billion were minted while over US$6 billion were burned.

For BUSD and USDC, we see minting at something like 2x the market cap increase with the extra 1x getting burned. So when USDC’s market cap grows by US$20 billion we see maybe US$40 billion of total minting alongside US$20 billion of burning. Why the difference?

Velocity of money

There is a concept in monetary economics of the “velocity of money.” Let’s just quote Wikipedia: “The velocity of money is a measure of the number of times that the average unit of currency is used to purchase goods and services within a given time period. The concept relates the size of economic activity to a given money supply, and the speed of money exchange is one of the variables that determine inflation.”

This sort of thing is tracked all over the world. For example, here’s a link to the St. Louis Fed’s FRED service for US velocity of money. Money changes hands something like 1 or 2 times per year.

This USDP data looks different. In 2020, USDP minted and burned over US$1.25 billion in tokens on a market cap nearer US$250 million. That’s some serious velocity. Paxos clearly subscribes to the Mario Andretti school of “If everything seems under control, you’re just not going fast enough.”

But is all velocity good velocity? This isn’t motor racing – it’s finance. The man may have completed the 24 hours of Le Mans at age 60…but this isn’t your typical head shot for a low-risk bond fund manager:

Detailed data

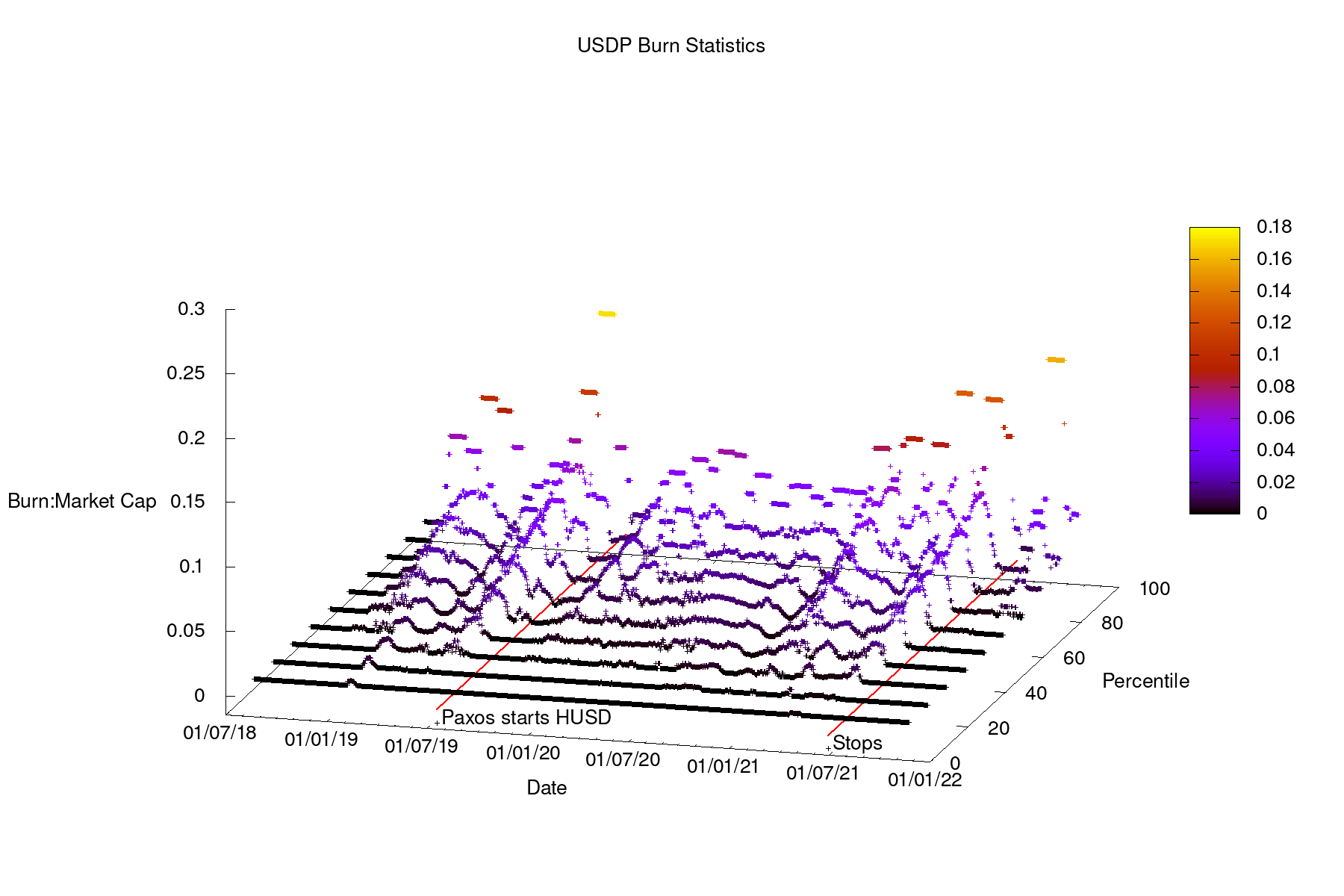

So let’s work out, daily, the burn-to-market cap ratio. It’s a bit noisy. This is all taken from raw on-chain transactions, so let’s also chart the average and median for 30-day periods:

OK, so in both cases the churn dipped dramatically following these announcements. And when the relationship was severed the velocity never returned.

This is odd. What kind of stablecoin routinely burns >5% of the supply in a single day? And why were we routinely seeing velocity numbers like 12 (3% daily is 30 days or 12x per year) which then dropped to the expected 1-2 range (0.25% is 400 days turnover)?

What’s going on?

These things are usable in DeFi, they just are not used. There are no minting fees either so it’s not like anyone has an economic incentive to encourage this activity.

We reached out to Paxos and the reply was that they don’t control this stuff and “that’s just the flow.” That is fair as far as it goes and there is no reason to think anything illegal or untoward happened here.

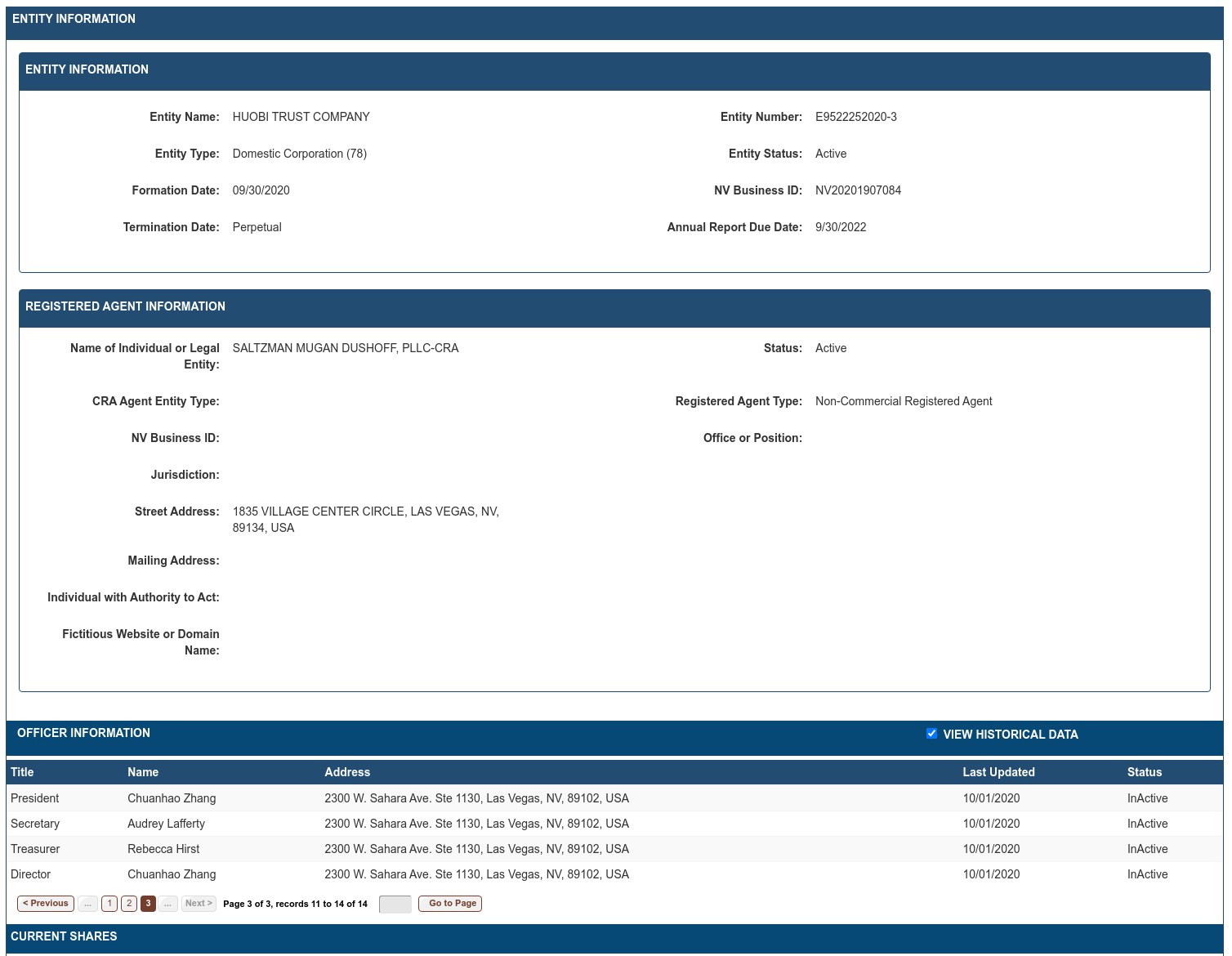

However, the referenced Huobi Trust above was incorporated in Nevada:

And it is reasonable to ask questions about the level of controls in Nevada and similar jurisdictions. This CNBC reporting explicitly references Nevada. As does this report by the Guardian. The Pandora Papers, it turns out, showed state trusts in the US could be used as vehicles for more-traditionally offshore financial activites. More info here from Bloomberg Law and straight from the ICIJ that originally broke the story.

This is all legal. But there is now reason to believe the cryptocurrency markets, and stablecoins in particular, may have found a novel route into the banking system:

- Set up a company

- Onboard that company to a trust in a weaker jurisdiction

- Transfer money to that trust in exchange for stablecoins

- Transfer those stablecoins to an exchange

- Swap this minor stablecoin for a major stablecoin

- Let a bigger player redeem the minor stablecoins for real USD

In this column we have established the first part of that workflow is plausible. Is there evidence for the second part? Yes, yes there is. This is a multi-part story for sure.