Table of Contents

This column explores cryptocurrency markets from the perspective of a somewhat-grizzled trading veteran with a quantitative background and perhaps too much experience doing derivatives janitorial work. Finance is an old industry with a long history of everything from productive innovation to cartoonish fraud. Here we take a grand skeptical tour of a new corner of that world, with two tools that have consistently helped traders for millennia in our steamer trunk: math and knowledge of the past.

Celsius filed a more detailed balance sheet and expenses recently with the bankruptcy court in New York. This puts us in a nice position to revisit a previous discussion of how Celsius was fundamentally misconceived. CoinDesk is also reporting that Celsius may run out of cash soon. There is an interesting legal question raised by the difference between their analysis and the math here. We will come to that at the end.

Current situation

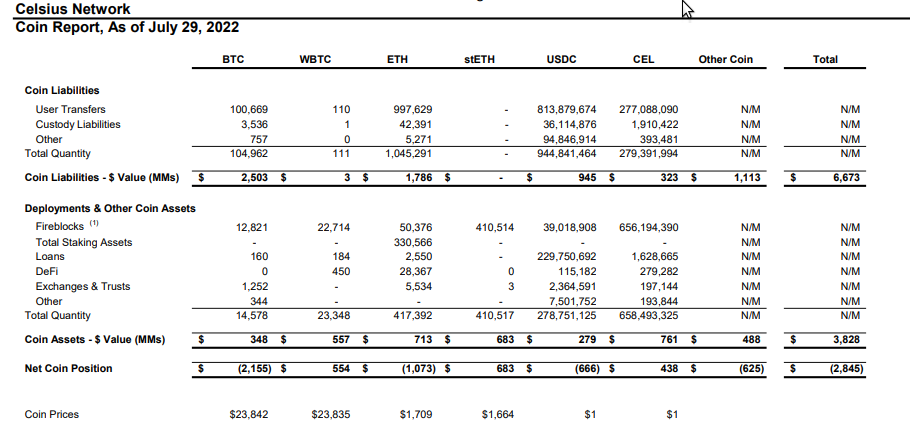

Let’s start with the balance sheet:

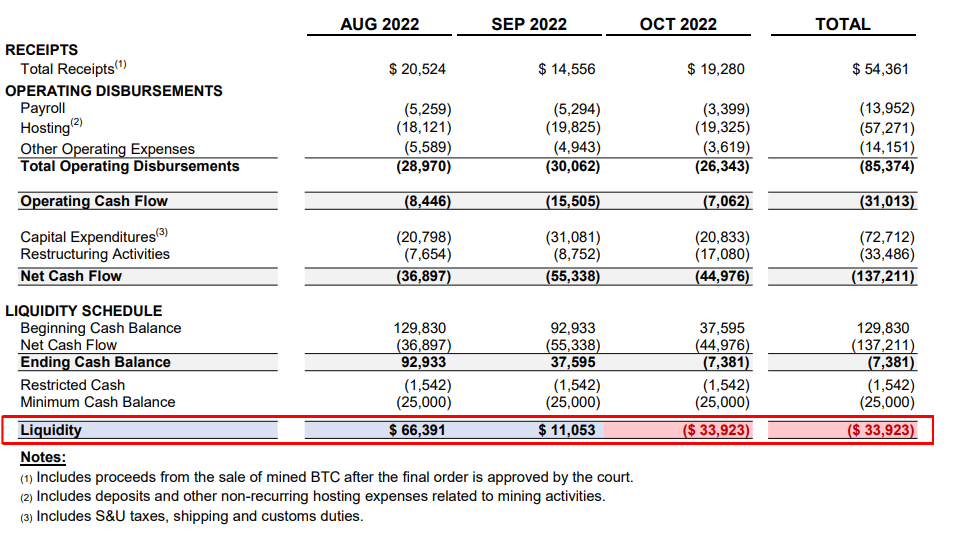

The cash flow statement is pretty self-explanatory:

They are cash flow negative about US$45 million per month.

Let’s assume the stuff under USDC is completely distinct from the “Beginning Cash Balance” and ignore the “Other Coin” section for simplicity. Then we can simplify as:

| Liabilities | Assets | Net | Net $ | Price | |

| BTC | 105,013 | 37,926 | -67,087 | -1,596,670,600 | 23,800 |

| ETH | 1,045,291 | 827,909 | -217,382 | -369,549,400 | 1,700 |

| USDC | 944,841,464 | 408,581,125 | -536,260,339 | -536,260,339 | 1 |

| CEL | 279,391,994 | 658,493,325 | 379,101,331 | 379,101,331 | 1 |

This adds the USD cash balance to the USDC holdings.

Now we can treat the business as a whole.

Simple model

This is a simplified exposition that shows how Celsius could have ended up here. Time will tell how close this is to the real story. But it is a good mental model to start from. Yes, they were active in DeFi. And yes, there were losses due to hacking. The point here is to see how promising unsustainable yield is fatal even without the problems.

We are going to work this out in parts.

BTC

Celsius was liquidated on a US$1 billion loan from Tether. If we assume that was around a price of US$50,000 and 130% overcollateralization that consumed 25,000-30,000 BTC. Celsius has 38,000 now. Let’s say customers deposited 85,000 BTC and were promised 10% yield for 2 years. That would balloon to ~103,000 BTC (85*1.1*1.1 = 102.85). But resting BTC earn very little. And they lost 30,000 to a liquidation. That would leave 85k-30k=55k left over. Let’s call that close enough. We are going to incorporate shrapnel trading and hack losses later. Suffice it to say the idea they lost ~20,000 BTC is not completely crazy.

Note this would inject US$1 billion of liquidity. We will need to account for that.

ETH

The ETH is even easier. If they took in 830,000 ETH and promised 10% return for 2 years they would owe just over 1 million ETH (830*1.1*1.1 = 1,004). Let’s just assume the entire ETH business was mistakenly staking some tokens and just hoping the yield would appear somewhere. They also surely lost at least 30,000 ETH.

USDC

This one is a bit complex. Let’s assume the same 10% yield as before and back out the USDC clients must have deposited. We get US$780 million (780*1.1*1.1 = 944). Where did the money go? Let’s try the following three places and see how we get on:

- Buying US$300 million worth of CEL to pump the price

- Receiving US$1 billion on a loan from Tether

- Spending US$45 million a month for 2 years

What is the total? 780-300+1000-45*24 = US$400 million. That’s their USD + USDC balance. And whatever happens post-bankruptcy, it is reasonable to think they treated them as interchangeable pre-bankruptcy.

That’s pretty close!

So as long as they spent something like US$300 million supporting CEL and lost ~20,000 BTC this works. It’s also fine if they spent US$200 million on CEL, lost another US$ 100 million, lost ~20,000 BTC and somehow sold the others in some scheme that produced the losses. The idea these guys spent or misplaced these kinds of amounts? That’s entirely reasonable.

Or, if they promised 12% and had this expense level back to the beginning of 2020 the “missing” loss is 750-400+1000-45*30 = 0.

Zero.

Without even spending money to support CEL. The token losses take care of whatever shortfalls exist there.

So long as their liabilities accrued 10-12% more than their assets and these expenses are broadly representative of their cash flow situation for the past 20-30 months…yeah, this should be close enough to correct.

If Celsius dropped in size before the collapse – in coin not in USD – then the yield gap might be even smaller. If you promise 5% on 500 or 10% on 250, the shortfall in USD is the same. If you then let half the depositors of the 500 withdraw the 250 looks like a 10% shortfall for whoever is left. Throw in some minor errors leaking 5,000 BTC and 10,000 ETH there and there and we are done.

So this should serve as a reasonable mental model for Celsius. Yes, it’s not going to be precisely accurate. But we can just about fit the known facts by viewing Celsius as a service that:

- Mistakenly staked ETH

- Pledged some BTC for a loan which they then defaulted on

- Promised 10%ish more yield to depositors than they could earn on the assets

- Spent a bunch of money pumping CEL

- Had high cash expenses

- Also lost some money due to bad trading and hacks

That’s it. It doesn’t need to be a complex story. And even without the losses and hacks this was going to end badly.

USDC in Chapter 11

The aforementioned CoinDesk article compares Celsius’ expenses to their USD cash balance. Cash and “assets” are not the same thing in bankruptcy. CoinDesk compares the US$129 million starting cash balance against the US$45 million monthly expenses and concludes they will be out of money soon.

But Celsius also has US$278 million in USDC assets. Some of those are “loans” and may look nothing like cash. Some might not even be recoverable. But, given the nature of Celsius’ business, an awful lot are likely short-term loans that will get repaid into USDC soon. And that looks like cash. They’ve also got US$50 million or so in USDC assets that already look a lot like cash. Fireblocks USDC arguably are as much cash as any bank deposit as they are just an API call away from being in the bank account of Celsius’ choice.

What are these things as far as the bankruptcy court is concerned? Go ahead and read the US Courts summary of how Chapter 11 works for yourself. Cash and ongoing expenses are not the same as assets. The CoinDesk analysis presumes USDC is an asset that needs to go through the sale process. Circle itself says “USDC is a digital dollar.” Presumably all of Celsius’ other USD are bank database entries and not physical cash sitting in the basement of the house Alex is selling.

This is a proper, and probably novel, legal question. Is CoinDesk right and Celsius needs approval to encash their USDC to pay expenses? Or do they have additional runway from USDC holdings and future receipts? What is Circle’s position?

The Celsius business model may not teach us much. But it looks like the Chapter 11 proceedings will.

Read more: Celsius & Euro Pacific as Spiritual Twins