Table of Contents

Bitcoin and other cryptocurrencies continued to trade sideways over the weekend, with the world’s largest cryptocurrency hovering just above US$23,000.

At the time of writing, Bitcoin (BTC) is trading at US$23,326.90 (+1.37%) while Ethereum (ETH) is trading at US$1,711.79 (+1.56%). Major altcoins such as Solana (SOL), Avalanche (AVAX), and Polkadot (DOT) have also been trading in green within the same time period.

Ethereum’s upcoming “Merge” continues to dominate headlines. Many of the network’s current miners are concerned that Ethereum’s transition to Proof-of-Stake (which does not require mining) will put them out of work, which is why some miners have proposed a hard fork, where they will be able to continue mining on the original Proof-of-Work chain.

Read more: A Forking Catastrophe

At the ongoing ETH Seoul conference, Ethereum co-founder Vitalik Buterin weighed in on the developments.

“I don’t expect Ethereum to really be significantly harmed by another fork. It’s because in general, my impression from pretty much everyone I talked to in the Ethereum ecosystem is that they’ve been completely supportive of the proof of stake effort, and the ecosystem has been quite united around it,” he said.

“I hope that whatever happens doesn’t lead to people losing money. But hope for the best,” Buterin added.

Meanwhile, Tron founder Justin Sun is supporting a hard fork, with the Sun-backed exchange Poloneix announcing that it will list both ETH and the forked token, currently termed ETHW.

Voyager resumes cash withdrawals

Embattled crypto lender Voyager Digital has announced that it expects to resume user access to the app for cash withdrawals by next week.

Voyager, who is currently in the midst of bankruptcy proceedings, gained court approval on Thursday to honour customers’ dollar withdrawal requests from Metropolitan Commercial Bank, where Voyager had a deposit account.

In a press release on 22 July, FTX announced that it will allow Voyager customers to create new accounts on its crypto exchange, while Alameda Research would buy all of Voyager’s digital assets and digital assets loans, other than loans to Three Arrows Capital (3AC), in cash at market value.

However, according to an earlier report by Bloomberg, Voyager has also received multiple bids for its assets in excess of the earlier offer from FTX and Alameda.

Sparrow ins MAS approval

Digital assets trading platform Sparrow Tech announced that it has obtained a Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS) to provide Digital Payment Token (DPT) services, meaning that it will be allowed to provide crypto services for users.

The Singapore-headquartered startup was previously issued an In-Principle Approval (IPA) from MAS in June 2022 following its MPI license application.

Established in 2018, the Singapore-headquartered startup offers digital asset products and solutions, including the use of PayNow transactions for institutional and high-net-worth clients who trade cryptocurrencies on its trading platform.

Currently, six other firms – DBS Vickers Securities, Digital Treasures Center, Fomo Pay, Independent Reserve, Revolut, and Hako – hold a DPT license from MAS.

Trading Volume

The global crypto market cap is US$1.10 trillion, a 1.51% increase since yesterday. The total crypto market volume over the last 24 hours is US$41.28 billion, a 7.72% decrease.

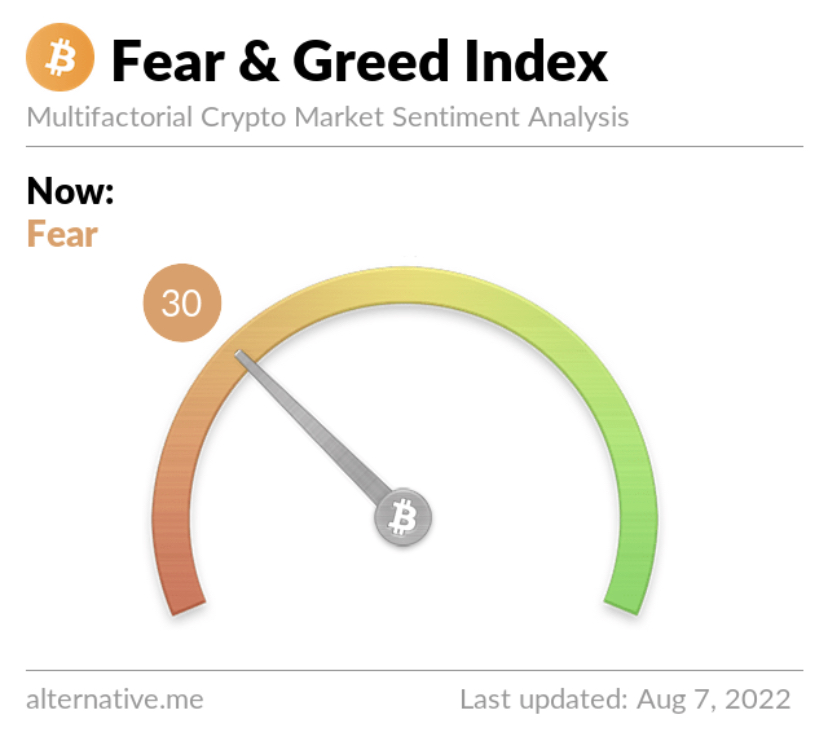

Fear & Greed Index

Risk appetites are still sapped – the Crypto Fear and Greed Index currently stands at 30, indicating fear. The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

The index has improved significantly from June, during which it fell to as low as 6 (extreme fear) in the wake of the Terra implosion.