Table of Contents

This column explores cryptocurrency markets from the perspective of a somewhat-grizzled trading veteran with a quantitative background and perhaps too much experience doing derivatives janitorial work. Finance is an old industry with a long history of everything from productive innovation to cartoonish fraud. Here we take a grand skeptical tour of a new corner of that world, with two tools that have consistently helped traders for millennia in our steamer trunk: math and knowledge of the past.

As the crypto universe continues to unravel, accusations of “Ponzi” are flying. And some individual projects probably are. But the space, taken as a whole, has one key difference with a Ponzi scheme: there are substantial real expenses. Someone has to pay Nvidia, TSMC, Bitmain and others for the mining hardware. Plus all the electricity.

Recall: the key element of a Ponzi scheme is that there is no underlying business. If you have expenses, you are something else.

In the Madoff Ponzi, the cash-on-cash recovery so far is over 80%. Investor returns were fabricated – but the underlying business consumed nearly no cash and, net of clawbacks, not so much money disappeared. Sometimes investors get all or nearly-all their money back. Sometimes the recovery is much lower because the operator steals the money. But the cryptocurrency space is unique in that it requires large, on-going, hard cash expenditures to operate. This is incredibly important for understanding what is happening and what is likely about to happen.

This is a story of inflow vs. outflows. How much cash came in and how much cash went out.

Cash in the system

How do we get a handle on cash in the system? For a country, we would look at trade or current account balances, or maybe some related trade statistics. Crypto doesn’t have those numbers. But what we can look at to get some sense are stablecoin quantities and the handful of listed company balance sheets. Algo stables aren’t cash backed so we can ignore them. USDT is, um, complex. But USDC, BUSD and then some shrapnel coins are cash-backed. And they constitute approximately US$75 billion of real hard currency.

Maybe skipping USDT is unfair. So what we are going to do is probably overcount stablecoin reserves within the listed companies we can find. Coinbase has US$7 billion in cash. Silvergate Bank has US$15 billion in assets. Signature Bank is tiny. Evolve Bank is tiny. Metropolitan Bank – of Voyager fame – has US$5 billion in assets. That isn’t the worlds most exhaustive search. So let’s round up and say there is somewhere between US$150 billion to US$200 billion of cash in “the system.” Some miners have raised public capital but nothing on the order of these numbers. It might be US$210 billion or so, but it seems unlikely these estimates are off by a factor of 2 or more. For example: we skipped the Gemini USD with a market cap of US$168 million which fits comfortably inside these ranges.

Leverage

Crypto’s current market cap is around US$1 trillion. So, even before leveraged lending platforms, we know a haircut of around 80% is in order.

But it’s worse than that. Leveraged lending platforms like Celsius, Voyager, CoinLoan, Vauld and Babel are promising returns in excess of their holdings – that’s why they won’t let people withdraw. That means with US$1 trillion in crypto outstanding, we might have people who think they are owed US$1.2 trillion or US$2 trillion or some other number.

Read more: Below 0° Celsius: When Your Deposit Gets Frozen

Can we estimate this? Well, 3AC looks like it had near-zero assets behind a US$10 billion balance sheet in the end. So their leverage turned out to be 9,999%. But Celsius, reportedly, has a hole of US$2 billion on a total of US$12 billion assets. CoinFlex has a US$50 million hole on who-knows-what-but-it-can’t-be-huge. CoinLoan put in limits not a total block so they clearly aren’t 100% insolvent.

Let’s take Celsius as the average and scale the whole thing up by 15%. So total liabilities are US$1.15 trillion against US$200 billion of assets. That’s an 82% haircut to cash out. If leverage is higher the haircuts are worse.

Cash expenses

The largest, and easiest to spot, expense in the space is hardware. Bitmain and MicroBT each have a few billion in revenue, all from crypto mining. Let’s call that US$10 billion between them (Bitmain is larger, but both are private so this is all based on media reports and is a rough estimate).

Now Nvidia sells a lot of mining hardware. And its revenue jumped from US$10 billion in 2019 to US$30 billion in 2021. Its last revenue peak coincided with the previous Bitcoin cycle top. Let’s call half of that crypto revenue. So that’s another US$10 billion/year. AMD is a bit smaller with maybe an incremental US$5 billion/year. TSMC, which makes a lot of everybody’s hardware, jumped from US$30 billion to US$50 billion. Again let’s just guess that as US$10 billion/year.

So these raw estimates suggest US$35 billion/year in cash expenses. At US$20,000 per BTC, the total revenue is ~US$6 billion/year. And with BTC at US$60,000 is US$18 billion/year on the current hash rate. This is all vaguely consistent with the idea miners are cash flow negative and need to borrow money against their coins or keep raising equity.

Not a Ponzi

It is clear users are trying to withdraw their funds. And it is equally clear the system cannot cash everyone out – and certainly not for the amounts they expect.

And we can now see the problem “the industry” as a whole faces. Let’s assume the only expense is hardware, no money was stolen and everything is 100% legit. Say we are now sitting with US$175 billion in cash, US$35 billion in annual expenses, and US$1.15 trillion in claims. The current haircut is ~80%. If we can freeze everything and somehow roll 1 year forward, the cash drops to US$140 billion and the haircut off current prices is ~90%. A year later it’s ~95%. It feels exceedingly unlikely there will be a system left if the cash balance runs down to the US$50 billion-US$75 billion range.

Bear in mind this isn’t even including electricity costs! Unless we see the hash rate dropping dramatically the recovery rate will keep dropping.

Ponzi schemes don’t work like this. Once the game is up everything stops and the cash-on-cash return goes up as the trustee works at clawing back assets. Every day this machine is in motion the recovery drops. And that’s not even assuming bad behaviour.

Now, maybe clawbacks will occur. Certainly some project and fund founders are going to face tough questions. But Nvidia and TSMC will not face clawbacks for the literal industrial quantities of hardware they sold. Nor should they. Same with the electric companies.

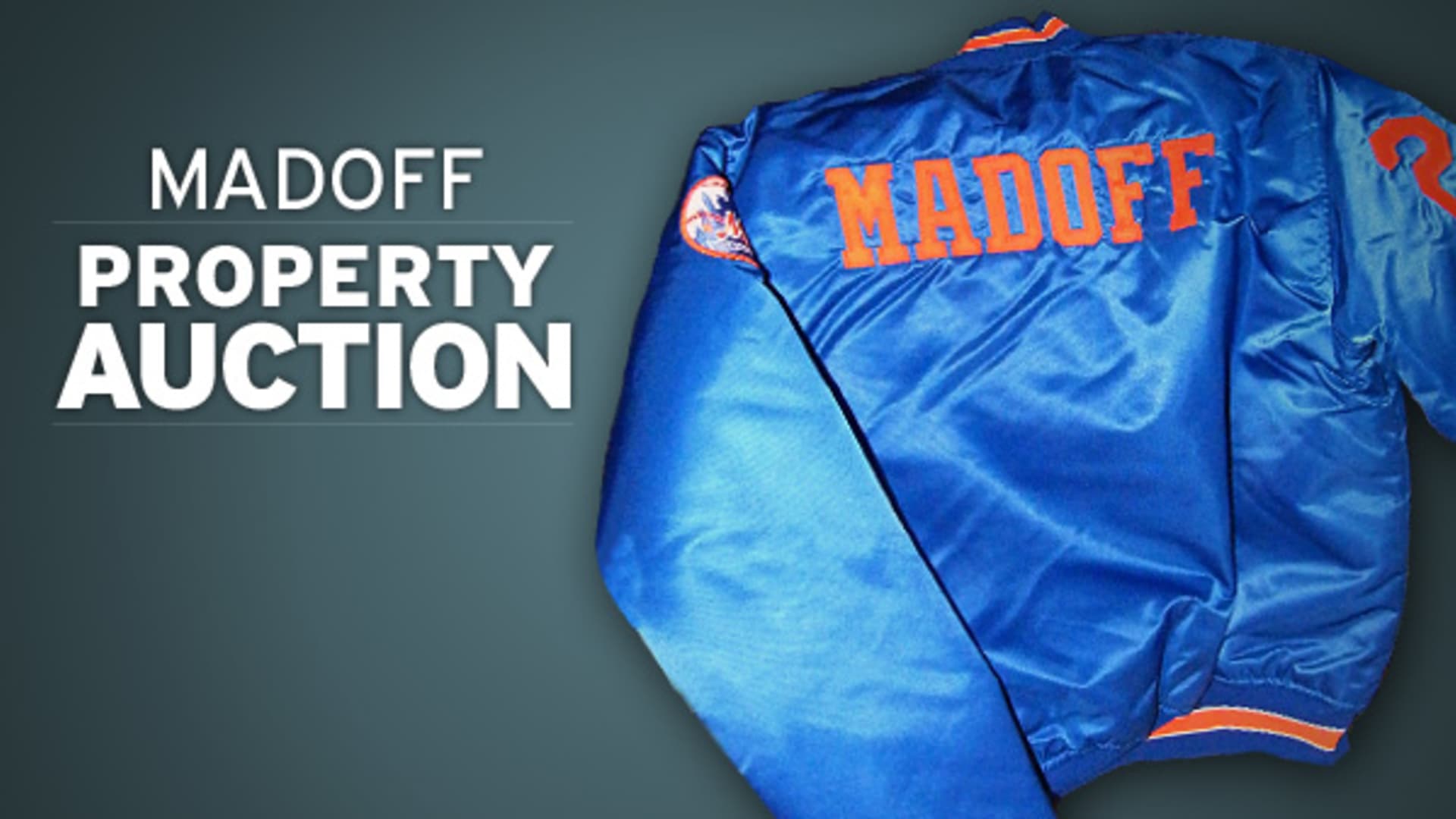

Bernie Madoff bought a lot of expensive stuff that was eventually auctioned off. But he didn’t buy US$10 billion worth of computers or pay the electric bill for Austria. This is not the same and is likely to be materially worse for anyone caught with funds in the system.

Slo-mo fund drain

Normally when a fraud collapses the cash outflows stop. Maybe they still pay the staff and rent but whatever marketing budget there was stops. Crypto is not the same. They still need to maintain these mining farms, replenish hardware, pay electric bills and so on. If there is a massive collapse in the Bitcoin hash rate and miners start to vanish…that kind of feels like the ultimate rug pull. A scenario where large players abandon the network and take home the cash is perhaps unlikely to be still conceivable.

So we are in a weird spot where, if the industry tries to keep up the pretense that everything’s fine, the cash is gonna get burned. Maybe the burn rate drops a bit. But there are large bills that must be paid to keep the Bitcoin and Ethereum networks online and hash rates even stable.

Overall regulators have acted slowly with respect to crypto both on the way up and now while things are catching fire. Normally insolvent financial businesses sort of freeze and the cleanup process runs at its own pace. This situation is different. If the authorities don’t start moving quickly there is unlikely to be any money left. And this is all assuming no nefarious activity – just the natural structure of what has collapsed has a far far stronger undertow than traditional finance. If there is or was malfeasance then a 80-90-95% haircut is optimistic.