Table of Contents

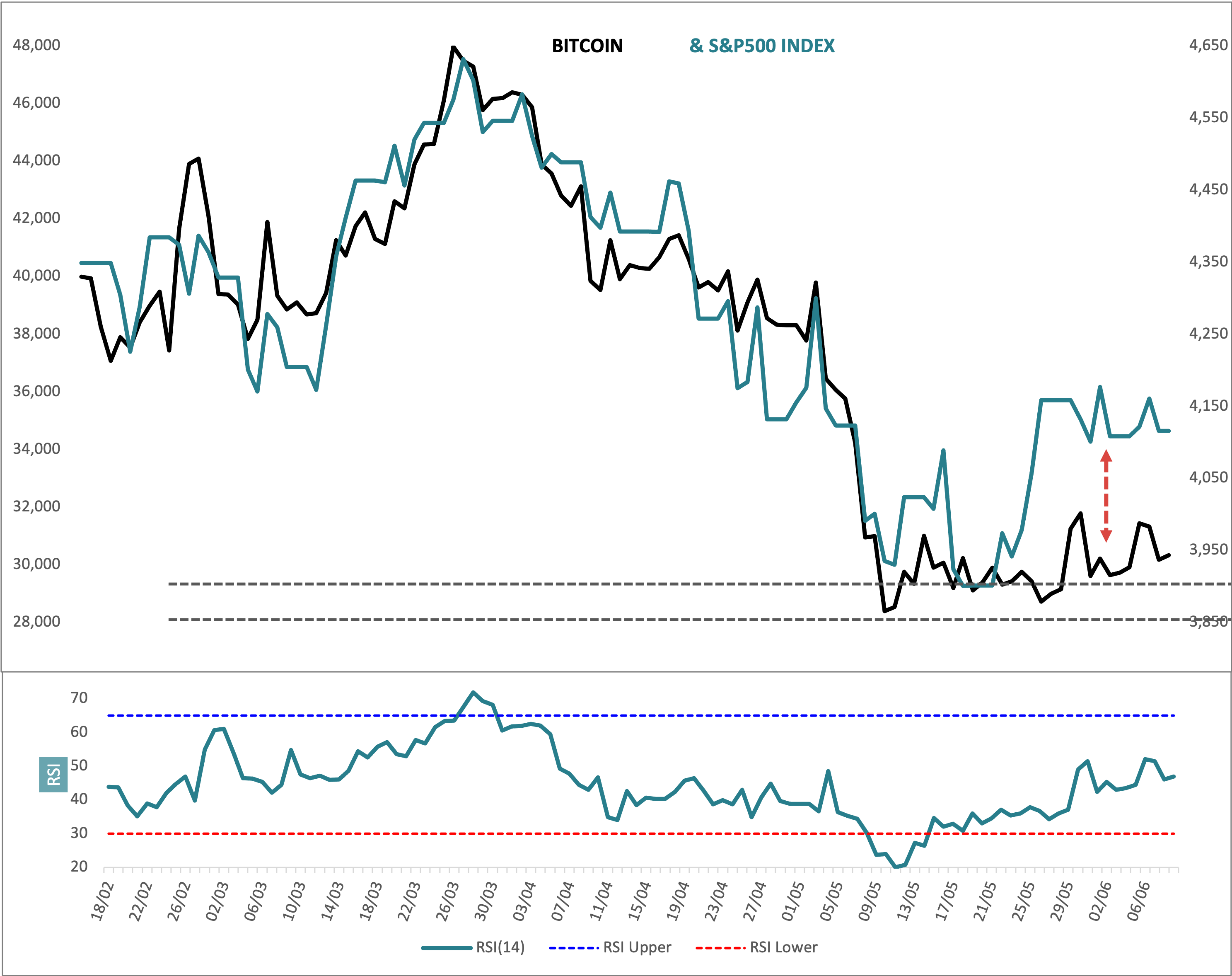

The correlation between Bitcoin and the S&P500 since the start of this year is 0.86, which means the two series move more or less together. Since the big low in the SPX in March 2020, the correlation is higher at 0.90. However, over the last month the correlation as shrunk down to 0.34, which means that a decoupling has taken place. This shows up in the chart quite clearly. The blue line (SPX) has tracked the black line (XBT) almost exactly until very recently when a spread has emerged (highlighted by the red arrow).

I ran a second correlation study for the six key uptrend phases in SPX since the March 2020 low and the average came to 0.70. The average was dragged down by two previous decouplings 4 March to 7 May 2021 (0.26) and 13 May to 3 September (0.46). After both of these decoupling events (and yes, I know its not much data to go on), both series fell back in line.

There isn’t a compelling conclusion here other than generally the two series follow one another, but occasionally they decouple. This is one such time. My preferred view on SPX is for an upside recovery out of the flat consolidation phase it looks to be undergoing currently. The preferred view is also that blue chip crypto is testing support and will rise, and that SPX and Bitcoin will recouple.