Table of Contents

Since last week, we’ve been in freefall. The US Federal Reserve’s rate hike and global risk have forced the Nikkei, European Stoxx and US S&P 500 index futures to all drop. US 10-year yields last traded at 3.14% which is only 0.1% lower than the top in October 2018, thereby nearly completing a multi year V-shaped recovery.

My concern is that the so called Fed put has ended (i.e. Federal Reserve backstopping equity markets which has made them more or less a one way upside bet) and that we are now in uncharted territory.

As I wisely warned before, crypto is tightly correlated to broad market risk and accordingly is falling in sympathy.

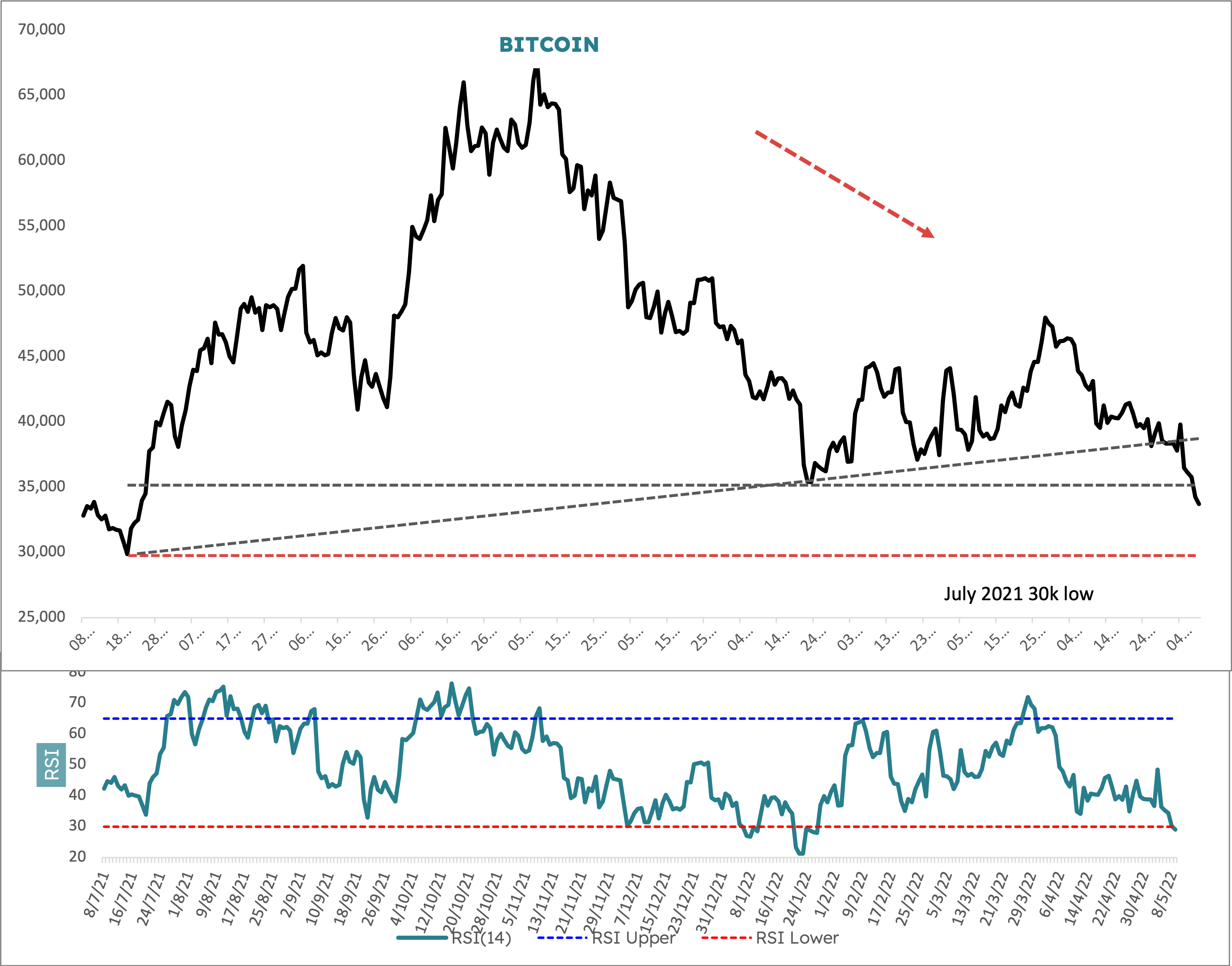

In today’s chart, I’d like to bring your attention to January’s lowest close being taken out as well as all of the promising support levels we monitored last week. It’s not unreasonable to assume here that Bitcoin is set up for a re-test of the US$30,000 handle last seen in summer 2021.

You have been warned.