Table of Contents

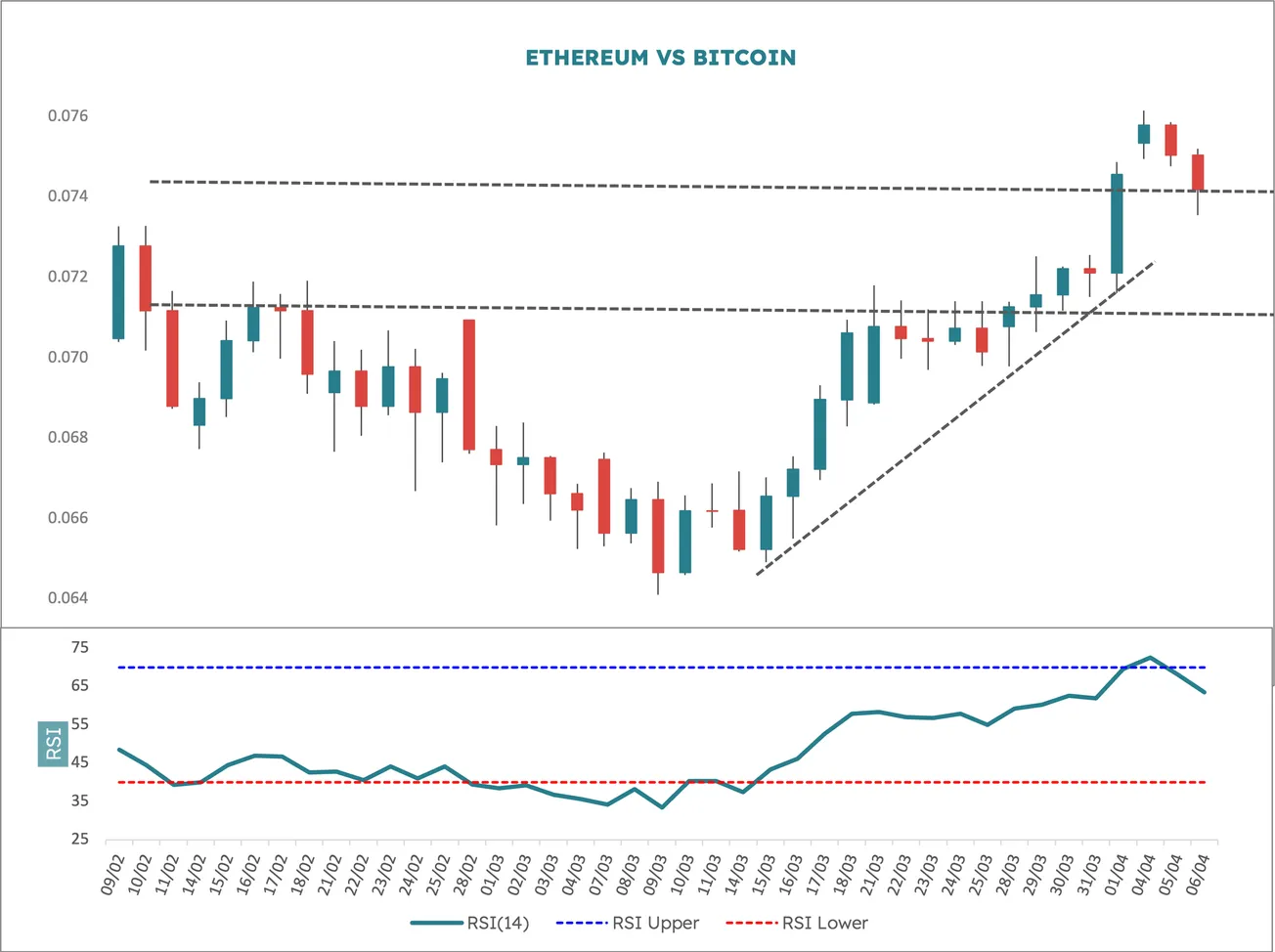

A price gap between Ethereum and Bitcoin is unfolding, indicating upside exhaustion. The implication here is that Ethereum will not outperform Bitcoin in April.

Two days ago the Ethereum-Bitcoin spread posted a real daily upgap, which is where there is no price print between the high of the previous trading session (in this case 1 April) and the low of the next closed session (4 April here). In other words, there is a price gap.

Coming after a strong upside run, i.e. a high momentum reading, these upgaps often signify upside exhaustion. Think of them as a last-gasp push out. Very often, but not in this particular chart, we see two prior gaps in the uptrend (but they can also manifest as long candle up days). There is often one at the start of the move called a breakaway gap and then often one mid-move called a runaway gap. After that, upgaps tend to be suspect and imply a frantic unsupportable advance.

As with any signal, it’s always best to test the idea by looking at the stats.

The ETH-BTC spread has daily data going back to 12 February 2018 – a sample size of 1,083 bars. On 31 occasions so far, the current low – L(0) gaps above the prior high H(1). In other words, it happens on average every 35 sessions. So let’s see if there is any statistical significance after this signal.

Over 3, 5 and 10 days, the average close to close price change is 0.07%, 0.21% and 0.56% respectively. However, after the real upgap signal over 3, 5 and 10 days, the average change is 1.15%, – 0.30% and 0.48%.

What this tells us is that the real upgap provides meaningful outperformance over three days, but this sharply reverses out to 5 days (i.e. goes negative) and somewhat underperforms out to 10 days. On this basis, we still have a few days of underperformance and then a flattening off in outperformance.

Looking further out, the average change over 20 days is 1.41% and after the signal 0.64%, i.e. less than half. The implication here is that Ethereum will not outperform Bitcoin in April.