Table of Contents

Have you ever listed your NFT on OpenSea, proceed to constantly refresh the webpage, check the floor price, amend your listing accordingly, and wait for the NFT to be sold? Or have you tried to aggressively click on the refresh button, to check whether the floor price of the project you want has decreased so you finally can afford it?

Well, I’ve done both. Why is it that I’ve got to keep my eyes peeled on the price? It’s because of the low liquidity that existing NFT marketplaces have.

Due to the non-fungible nature of NFTs, there is hardly instant liquidity on marketplaces, and thus we have the illiquid JPEG meme. A new player has entered the arena, looking to resolve this critical issue, plaguing that of NFT traders and collectors.

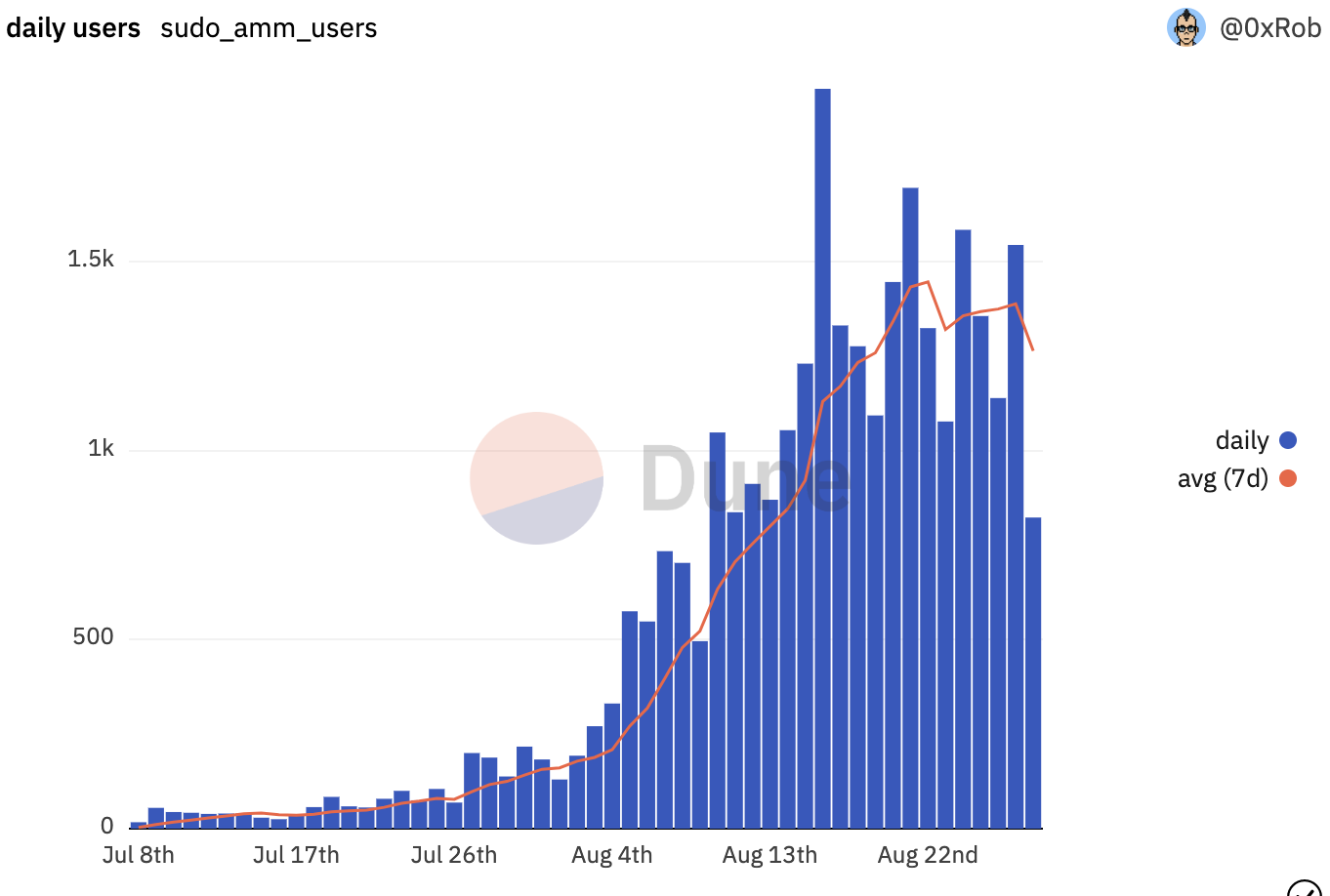

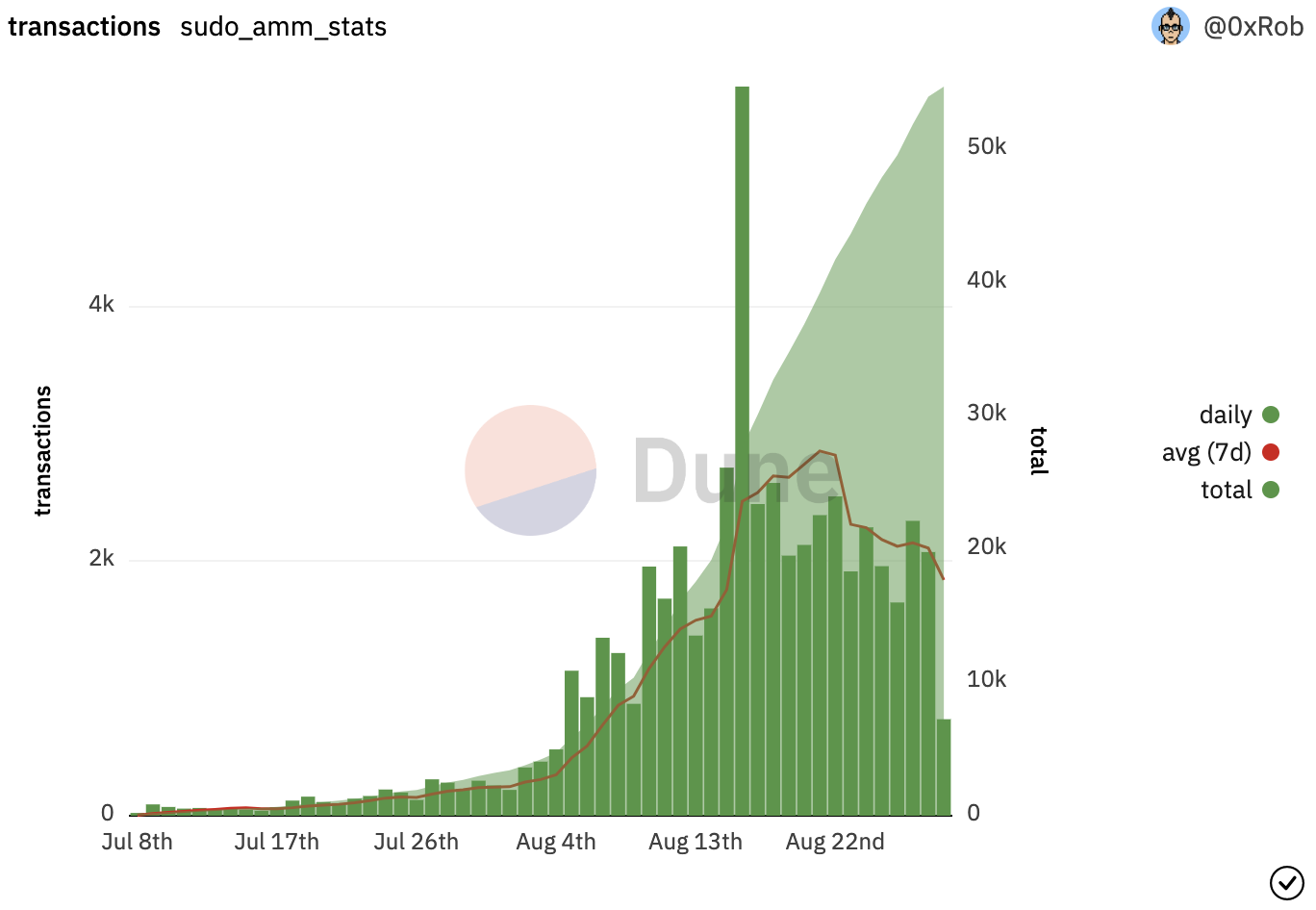

And that is none other than Sudoswap, the first NFT automated market maker (AMM), which has seemingly become the NFT market’s new favourite child, with daily active users (DAU) having increased by 90x, peaking on 16 August 2022 with 114x the initial DAU. And that is since the launch on 8 July 2022, merely 2 months since its launch.

So what is it that has allowed Sudoswap to gain so much attention within a relatively short time frame? Buckle up as we take a closer look.

What is Sudoswap?

Sudoswap was founded by 0xmons, a pseudonymous developer known for being a veteran in the NFT space with his 0xmons pixel monster collection powered by machine learning. In July 2021, 0xmons also released a whitepaper on liquidity provision for NFTs before eventually launching Sudoswap.

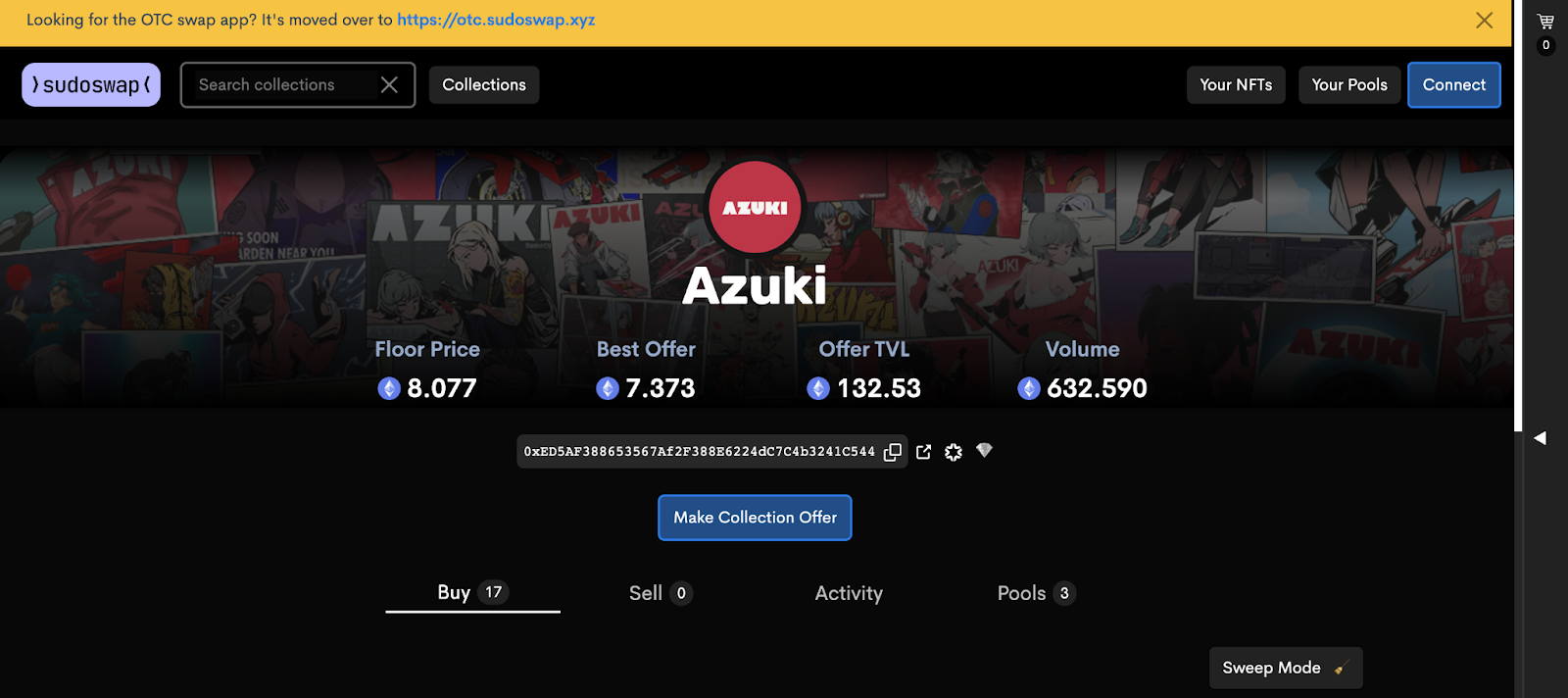

Sudoswap is essentially a NFT marketplace powered by 0x protocol, and supports multiple ERC token standards such as ERC-20, ERC-721 and ERC-1559. On 8 July 2022, the team released SudoAMM, integrating an AMM model into Sudoswap. With this, liquidity pools were introduced into the NFT vertical, and allows users to access the following:

- Buy Pool

Users can deposit ETH to purchase NFTs. Presuming I would like to purchase a certain number of NFTs, I can create a buy pool. With every NFT that I have purchased, the pool will automatically decrease my buy price by a certain percentage (known as delta). This allows me to dollar cost average (DCA) into the NFT project, without having to constantly check the price and make new bids or transactions.

- Sell Pool

Users can sell their NFTs for ETH. Should I have more than one NFT in the collection, I can set up a sell pool. With every NFT in my pool that is sold, the pool will automatically increase my sell price by a certain percentage (known as delta). This will allow me to sell off my collection at a more favourable price, instead of selling everything at the floor price.

- Provide Liquidity

Alternatively, one can also become a liquidity provider (LP) by providing both NFT and ETH into the pool. This combines the mechanism of the above buy pool and sell pool. In addition, LPs will be entitled to collect fees when they provide liquidity.

Why Sudoswap?

Now that we have a better understanding of what Sudoswap is about, let’s look into why it’s been able to gain so much traction within a short span of time.

- Improved liquidity on NFT marketplaces

This is one of the main aspects that Sudoswap is addressing, evident from the founder’s description of Sudoswap being “capital efficient protocol for NFT liquidity.” Due to the non-fungible nature of NFTs, provision of deep liquidity on NFT marketplaces have constantly been an issue, with sellers being unable to sell their NFTs with ease, having to wait for a period of time before their NFTs are bought. This is especially worse for higher-rarity NFTs with a much smaller pool of willing buyers. In addition, the lack of liquidity has also caused NFT holders to experience slippage when transacting their NFTs. Evidently, the existing state of the NFT marketplace is quite liquidity-inefficient.

Efforts have been made to mitigate this issue – through the fractionalisation of NFTs. Despite improving liquidity, the downsides brought about by NFT fractionalisation include being limited to trading portions of an NFT, while there might be users who would still want to trade full NFTs. Furthermore, with fractionalisation, NFT composability is negatively affected and limits the use cases outside of the original ecosystem.

Through the concentrated liquidity AMM model introduced by SudoAMM, NFTs can be traded using liquidity pools instead of having to match buyers to that of sellers. This allows users to buy or sell an NFT immediately without having to wait. Furthermore, with concentrated liquidity, users will be free to customise the price ranges that they wish to provide liquidity to, giving them more control over how they wish to price their assets.

- Lower fees/cost efficiency

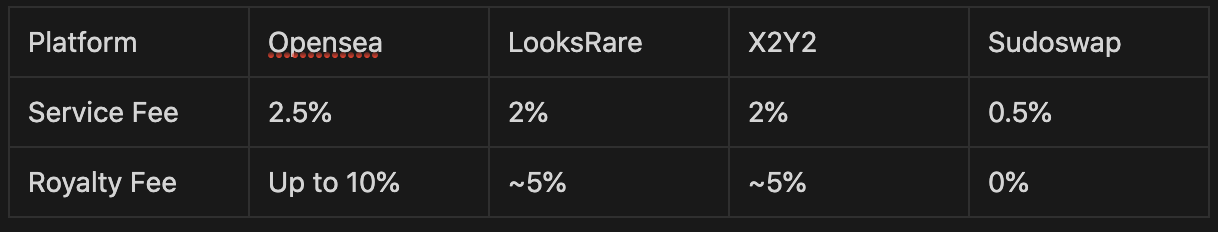

There are mainly two kinds of fees that are collected when a transaction is made on a NFT marketplace:

- Service fee: Taken by the marketplace

- Royalty fee: Fees given to creators

Existing NFT marketplaces poses relatively higher fees, with the following fee structure:

For both LooksRare and X2Y2, 100% of the service fee collected will be returned to their token stakers. Nonetheless, these fees are still considered relatively high and would impede traders’ profits.

Sudoswap takes just 0.5% in service fees, and the fees collected are kept in Sudoswap’s treasury. Seems like very favourable terms for users indeed, granting them higher profit margins. But without royalty fees, wouldn’t it be a disadvantage for creators? Hmm, more on this later.

In addition, as mentioned by the founder 0xmons, Sudoswap optimises cost efficiency by having underlying infrastructure that allows users to interact with just a few tokens, thereby reducing the gas fees paid. Bulk transfers are also possible on Sudoswap, helping users to save on higher gas fees when making individual transfers.

NFT Paradise? Hmm

Seems like a rosy picture, and all sounds lovely. But is that all to it?

Royalty-free – Yay or Nay?

One of the controversial aspects of Sudoswap that has been discussed is that Sudoswap is royalty-free. This means that NFT creators are not rewarded with royalty fees for every transaction made on the platform, unlike that of OpenSea, LooksRare and X2Y2, essentially translating to a lack of consistent revenue for creators.

Crypto Twitter holds very differing views towards this.

they understand the money part. they will tell you royalties and fees can be added by folks,, but @sudoswap was marketed as no royalties lower cost nft trading. assholes. not participants in creator economy. stealing from creators by bypassing royalties by default.

— j1mmy.eth (@j1mmyeth) August 8, 2022

On one side, we have got those that are strongly against that of a royalty-free platform. This is coming from the stance that creators would be disadvantaged, and are being “robbed” of their revenue.

When NFTs boomed in 2021, one of the greatest value add brought about by the NFT industry was that artists could now benefit more from their IP creation. By taking away the middleman (studios), artists were granted the opportunity to earn the bulk of the profit through NFTs. With a “no royalty fee” feature implemented, the consistent source of income for artists is essentially removed.

And we have also got the other camp, which is in favour or neutral towards “royalty free,” as they believe that whether or not royalties are granted would not be a huge concern for the creators.

It’s extremely simple. They are altcoins with pictures. Anything suggesting otherwise is larp and cope.

— Cobie (@cobie) August 14, 2022

Yeah but shitcoiners sold their shitcoins for over a billion dollars, so doubt they care much about the royalties, which will be gone soon anyway

— Cobie (@cobie) August 14, 2022

It’s a free market that we play in, and eventually, whether the creators deem royalties as something essential, or something that can be done without, will be evident through the traction that Sudoswap gains, and whether they can maintain it.

Exploits/rugs/forks

As with every protocol, we can’t run away from the possibility of exploits and rugs. This is not just limited to that of Sudoswap itself. Just last week, a fork of Sudoswap, known as SudoRare, drained users of 519 ETH, worth US$820,000 at the time of the rug.

#PeckShieldAlert #rugpull Seems like @SudoRare rugged 519 $ETH (~$815k).

— PeckShieldAlert (@PeckShieldAlert) August 23, 2022

SudoRare already deleted its social accounts/groups, sudorare[.]xyz is down

Stole funds already transferred to 3 new addresses (173 $ETH/address):

0x75c3b2…3981

0x0498d1…8074

0xbFb784…7EAa https://t.co/mPC4bl4k6W pic.twitter.com/O5D7jThYvm

And as with any protocol that gains the attention of the broader market, it is likely that more forks will emerge in time to come, given that it exists in an open source world. To stay competitive, not only will Sudoswap have to think about how they can remain unique in terms of the features they provide, they will also have to keep on improving their user interface to ensure a pleasant user experience.

This is especially important in the face of competitors such as OpenSea, which has an extremely friendly user interface that has proven to cater to that of the market’s likes.

More to come

Despite the above mentioned limitations and risks to Sudoswap, I’m excited about what’s to come for them.

$SUDO token

Sudoswap has announced that there will be the release of the $SUDO token. Information has yet to be released with regards to the distribution. Once the $SUDO token has been released, it would be good to keep an eye on the utility and value accrual towards it, for that would determine whether further demand can be created for the token and eventually expand the ecosystem and user base.

A cautionary note here would be that the market might be anticipating the $SUDO token airdrop and is thus participating in the Sudoswap ecosystem. If this is the case, there is the possibility that the traction achieved up till date might not be entirely organic. We will thus have to keep a lookout and be wary of potential selling pressure after the airdrop.

Upon the release of SudoAMM, Uniswap has announced that they will be launching a NFT platform with Sudoswap integrated. Uniswap is the leading decentralised exchange (DEX) with $996.6 million in trading volume over the past 24 hours and has recently overtaken Ethereum in terms of fee generation.

Having the backing of a market leader could be beneficial for Sudoswap’s future traction, both in terms of the market size it could access and also a stronger marketing angle.

Continued growth

0xmons is an experienced player in the NFT vertical, and has managed to achieve insane traction with Sudoswap, with the total transactions having increased by 44,000% within two months.

In addition, it should be noted that Sudoswap managed to achieve significant traction despite the general NFT market taking a severe hit, with the NFT trade volume decreasing by 94.8% from a high of $1.77 billion in May 2022 to the current $91.85 million (Aug 2022).

Presuming better market conditions and increased NFT volume, I am of the view that Sudoswap will be able to perform even better.

Note: Figures provided are accurate as of 29 August 2022.